2025 Market Perspectives

2024 was another great year in financial markets.

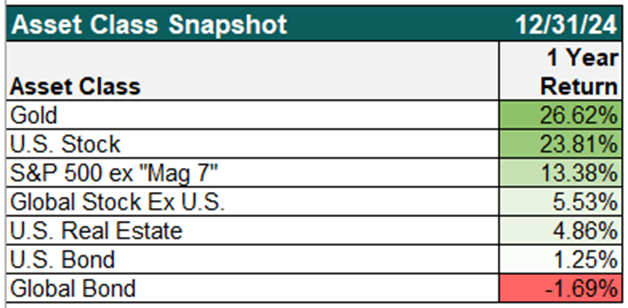

Below we have a summary of 2024 returns:

.

(note the significance in excluding the Magnificent 7 stocks from the index)

.

It’s always nice to have positive performance and to take a moment to appreciate this.

And for you bond investors, a silver lining is that price performance wasn’t as strong because yields have been increasing. This of course depends on the bond, but higher interest payments are a nice silver lining.

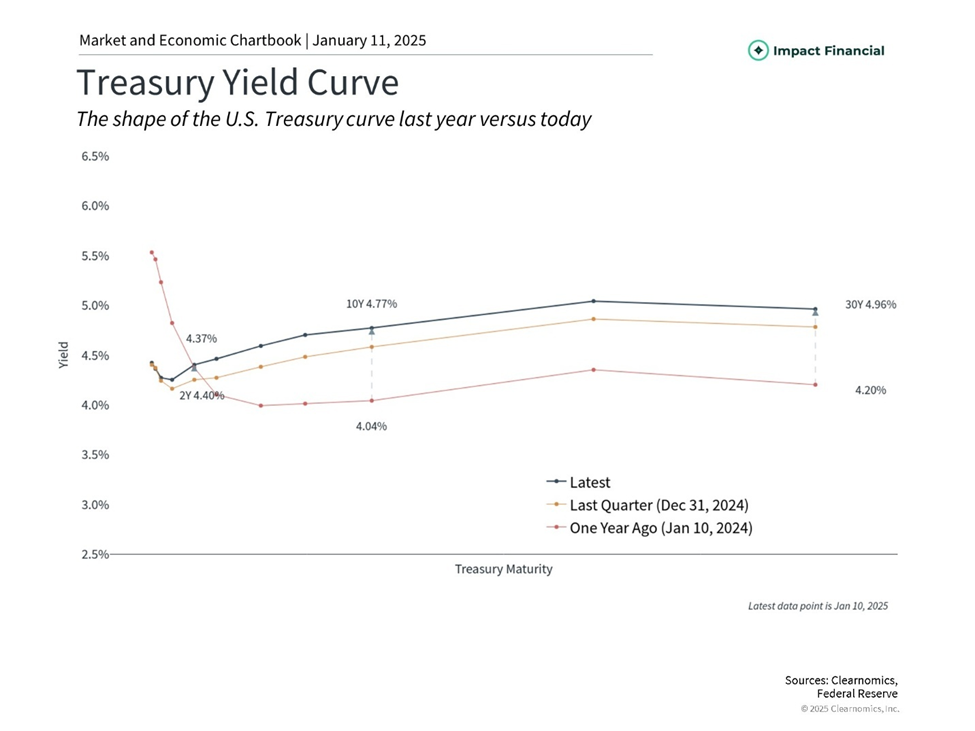

For the interest rate movements, see the treasury yield curve shifts below:

.

.

You can see the yield curve has continued its increase in the first few weeks of the year as well. For a 10-year Treasury, the interest rate has increased by 0.73% (1/10/24-1/10/25).

The yield curve and interest rates are a good starting point for reviewing the market, as rate implications have been driving much of the market movement recently.

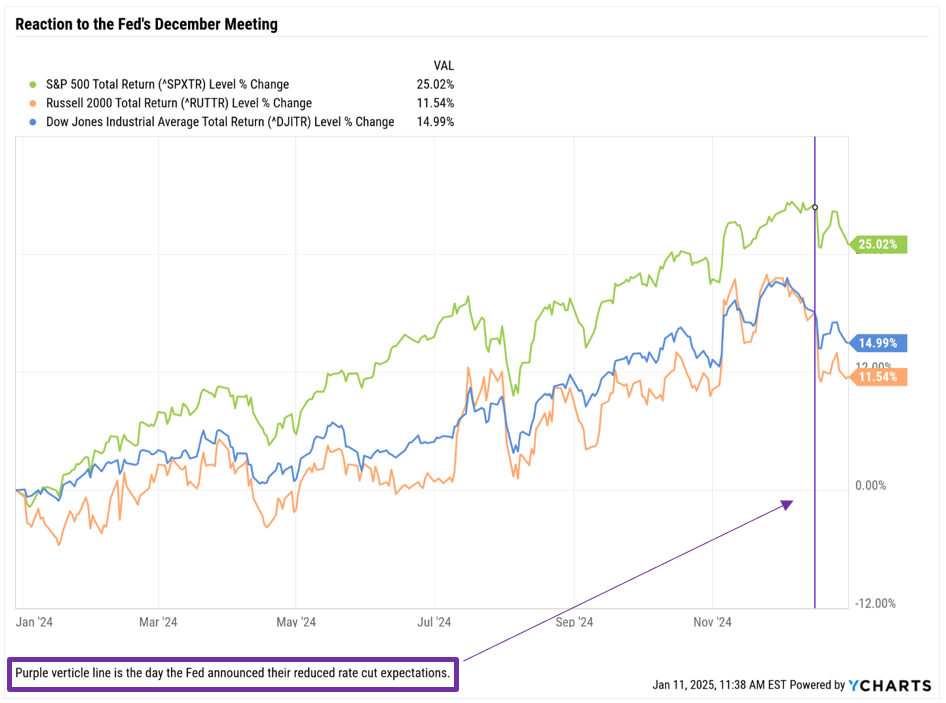

In December, the Fed signaled a reduction in its rate cut expectations, and the market sold off accordingly.

.

.

As always, investing requires a balance between appreciating the near-term changes while maintaining a long-term focus.

It gets counterintuitive and noisy when looking at the short term. The economy for example is in a generally healthy state. And this is part of what helps the Fed justify keeping rates higher.

So, a healthy economy can lead to the Fed keeping rates higher, which the market then reacts poorly to. But a healthy economy is a good thing, right??

This is oversimplifying a bit, but the point is, there are a lot of moving pieces and short-term movements aren’t always in line with long-term expectations.

As rate expectations change and as we adjust to a new political regime, there will no doubt be “shocks,” just like December.

And there’s always a long list of items that could lead to a longer downturn as well.

But just as the market had a negative December, while economic data has generally been positive, the same can be true on the flip side. If the Fed keeps rates higher for longer, slowing the economy, the Fed can then decrease rates to stimulate the economy and spur a market rally.

Short-term, there will be volatility as new data and implications come into the market.

Long-term, if companies are profitable and growing, investments in those companies end up doing well (see disclosures – of course there’s variance here).

This is another over simplification, but I find it helpful when news is focused on what the interest rates will be for 2025 and the stock market implications. While those implications are important, we can’t predict the exact movements and the exact timing. We can though have more certainty in companies adjusting and earning a profit over the long term, whether the interest rates are set to 4% or 3%.

With a relatively healthy economy and a Fed who is still supportive, there is a lot to be optimistic about.

For drawdowns in the short term, these represent good buying/rebalancing opportunities.

And diversification is helpful to weather any storm. Having assets that go up when others go down makes rebalancing efforts even more impactful.

With this in mind, one diversifier to be especially mindful of will be investments that do well during times of inflation. This is a common blind spot with portfolios as stocks and bonds can both do poorly during inflationary times. We saw this in 2022 and are seeing this again towards the end of 2024 and start of 2025 (stocks and bonds both having a downturn).

Changing Index Exposure

Beyond the initial economic and interest rate considerations, I’d be remiss if I didn’t visit another changing dynamic that could catch a lot of investors off guard.

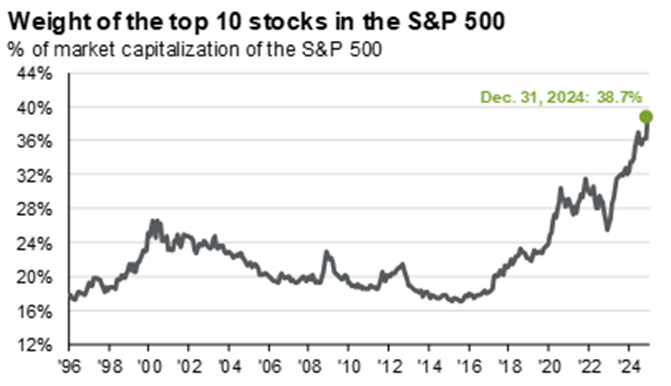

The most common stock indices continue to push concentration risks to historic levels. The S&P 500 for example has nearly 40% of its exposure in 10 stocks (see below):

.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. The top 10 S&P 500 companies are based on the 10 largest index constituents at the beginning of each quarter. As of 12/31/2024, the top 10 companies in the index were AAPL (7.6%), NVDA (6.6%), MSFT (6.3%), AMZN (4.1%), GOOGL/GOOG (4.0%), META (2.6%), TSLA (2.3%), AVGO (2.2%), BRK.B (1.7%) and JPM (1.4%). Guide to the Markets – U.S. Data are as of December 31, 2024.

.

You can see how this level of concentration is at a historic extreme. And this changing dynamic will be true in total stock market funds, target date funds and many other common indices as well.

This has been just fine going up, but many investors likely are un-aware of this level of concentration and lack of diversification.

If you have any general index or target date fund exposures, we recommend a portfolio review to ensure your exposure is in line with what you are intending.

Going beyond the relatively high concentration, these top stocks also have historically high valuations (price/earnings).

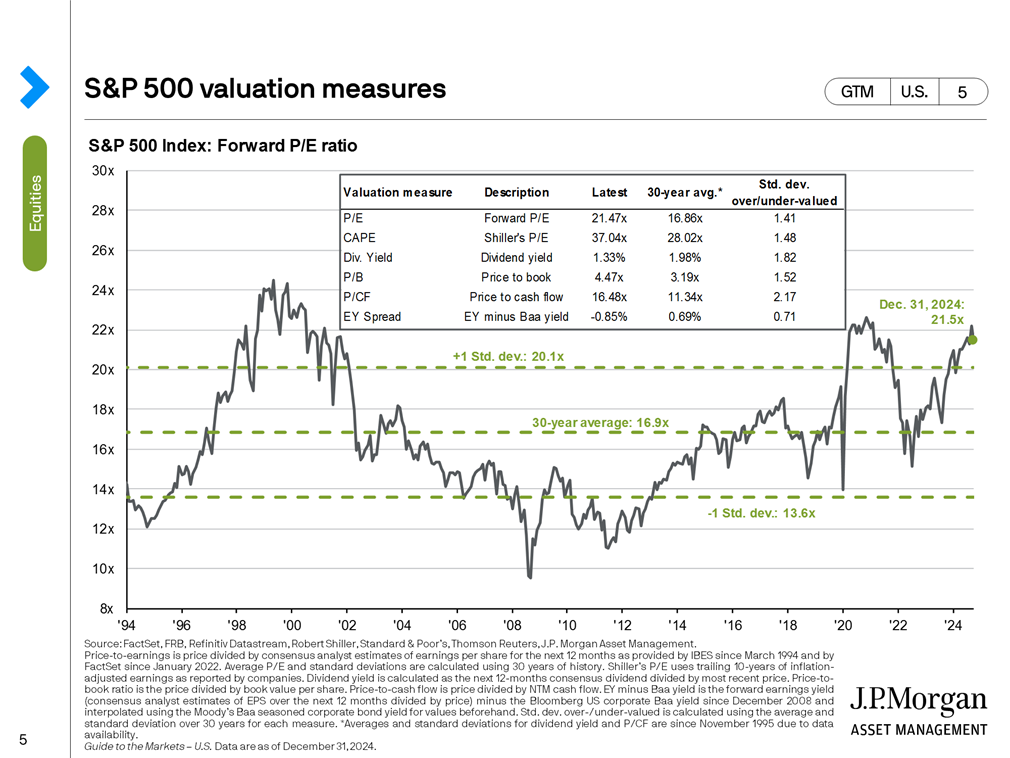

Price to Earnings Ratios of the S&P 500 as of 12.31.24:

(estimated forward 12-month earnings)

Comparatively, the 30-year average P/E ratio is 16.9. See the chart below illustrating S&P 500 forward P/E ratios over time:

.

.

Investors should always be aware of and intentional with their exposure, but especially given these historic concentrations and valuations.

These dynamics are also reminding us of cycles we’ve seen before.

The two charts above show similar spikes in valuations and concentration levels during the 1990s, when dot-com and other tech companies experienced their run-up as well

Going beyond valuations and concentration levels, how did the S&P 500 and other indices actually perform during these times?

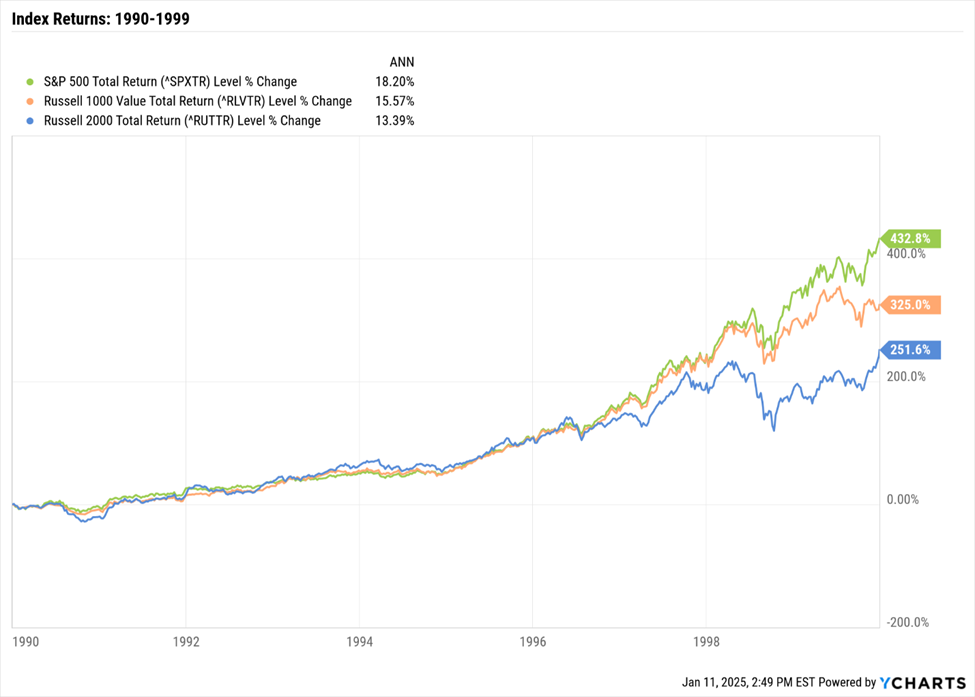

We have 3 charts below showing total return performance for the S&P 500, the Russell 1000 Value (US Large Value index) and the Russell 2000 (US Small Company index):

.

.

Starting off with performance in the 90s, you can see that the S&P 500 index did indeed pull away from other types of stock exposure, given the US tech growth.

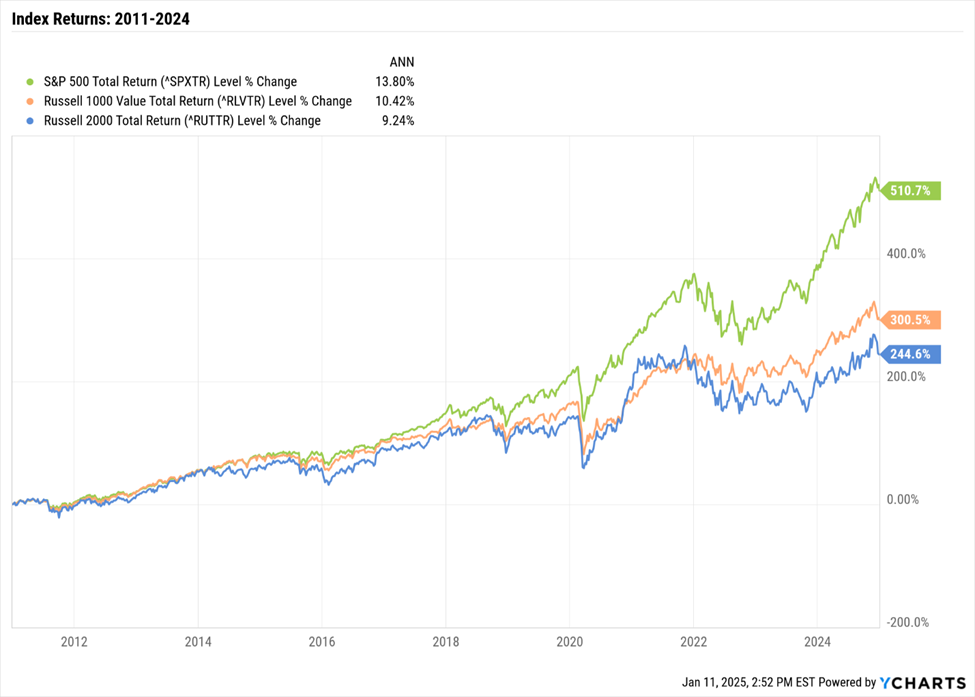

Next, let’s compare our recent performance (2011-2024):

.

.

You can see another dispersion, similar to the 90s, with the S&P 500 pulling away from the other exposures.

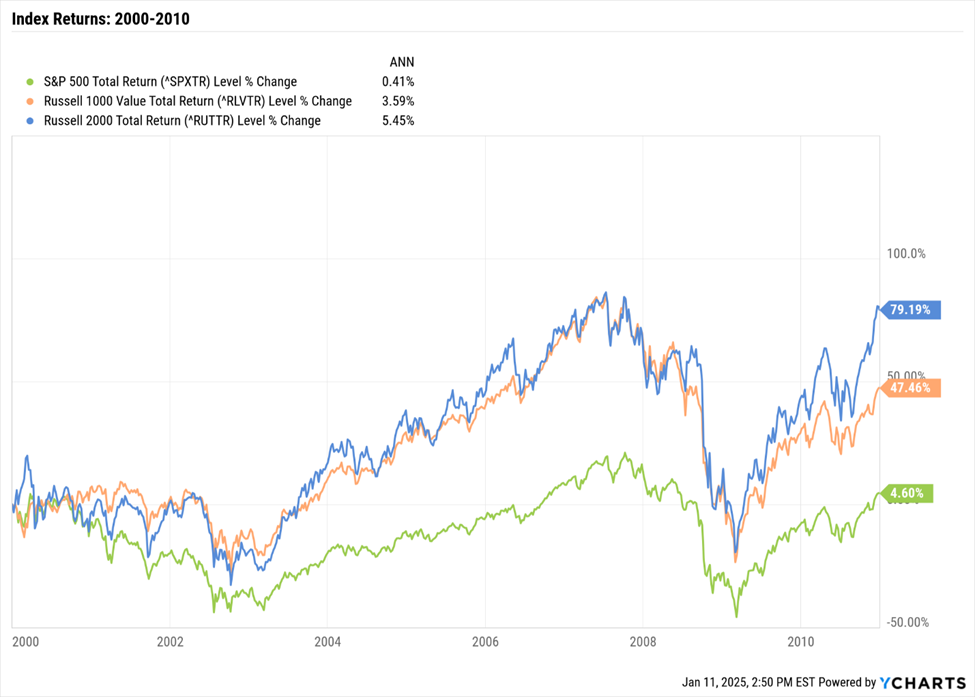

Now let’s look at performance between the two periods (2000-2010):

.

.

This is quite a different story for the early 2000s. For the entire decade the S&P 500 returned 4.6% (0.41% annualized).

Looking at other asset classes though, it wasn’t an entirely bad decade. Value and small cap stocks returned 5.45% and 3.59% (annualized).

Those may not be returns to write home about, but they are drastically better than what the S&P 500 returned. And on a 20-year basis (1990-2010), value and small caps came out ahead as well.

No one can predict the future, and I’m not necessarily predicting an imminent crash. The time periods above do capture the ’08 crash, which was historic as well. But as the S&P grows in concentration risks and valuation levels, this is a nice historical reminder that not all areas of the market are the same. There are always changing risks and opportunities and it’s important to be intentional and thoughtful on your exposure.

I hope these perspectives are helpful as you think about the road ahead. And as always, please reach out if you’d like to discuss your portfolio or plans further.

.

Disclosures:

Commentary is provided only for informational purposes and should not be taken as investment advice. Commentary is general and investment advice should be unique to each individual. Please consult with a trusted advisor to receive advice specific to you.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Investment products are not FDIC Insured and may lose value.

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure.

Y Chart Source Data is based off of the following indices:

Asset Class:

US Stock – Russell 3000 Total Return, Global Stock Ex US – MSCI ACWI Ex USA Net Total Return, US Bond – Bloomberg US Aggregate, Global Bond – Bloomberg Global Aggregate, US Real Estate – Dow Jones US Real Estate Index Total Return, Gold – S&P GSCI Gold, S&P 500 ex “Mag 7” – S&P 500 index excluding the following stocks (MFST, TSLA, AMZN, NVDA, META, AAPL, GOOG).

January 14, 2025