Expectations & Considerations for 2023

- Inflation has already started to cool off and is expected to return to moderate levels sometime in 2023.

- Interest rate hikes are expected to continue at the beginning of the year, but are expected to slow down, stop and may reverse as the year progresses. Given the expected shifts in monetary policy/interest rates, monitoring these changes will be important in case portfolio or financial plan adjustments are needed.

- As interest rates continue to increase, the economy and corporate earnings are expected to contract. A recession isn’t necessarily imminent, but we could tip over into a technical recession. If we do, we would expect the recession to be relatively mild.

It is worth noting that the stock market and the economy are two separate things. The stock market is forward looking and may rebound before the economy does.

- Long term growth rates for US equity markets are projected to be lower than what we have experienced in the past. To help prepare for this potential decrease in returns:

- Invest in a globally diversified portfolio, outside of just US equities.

- Continue to keep your financial plan & tax plan updated.

- Your financial plan identifies areas to add return outside of your portfolio (tax savings, debt/cash flow strategies, etc.). This is a great way to add to your net worth, regardless of what the market is doing.

- Your financial plan identifies the rate of return needed to meet your goals and stress tests future growth rates.

- Investors should still consider these down markets as an opportune time to invest. Markets don’t wait for a specific interest rate or “end of recession” announcement to bounce back. Down, volatile markets present opportunity to invest before performance shifts back to growth.

.

We can’t predict short term changes and our environment is ever changing, so comments about expectations should always be taken with some grain of salt.

But we are in a fairly unique environment heading into the year, facing some significant shifts in our economic and market environment. We certainly aren’t on “cruise control” anymore. Inflation will eventually cool off, interest rate policy will eventually shift and markets go through down & up cycles.

Given these expected shifts, we should be prepared to make portfolio and financial planning (inflation & interest rates affect more than just investment returns) adjustments when needed.

Of course, we will continue to monitor and communicate the evolving opportunities and threats to clients. And if you ever have any questions or concerns about the market, economy or your financial plan, we are always a call or message away.

For additional commentary on the bullet points above, see the write up below.

.

Inflation Cooling

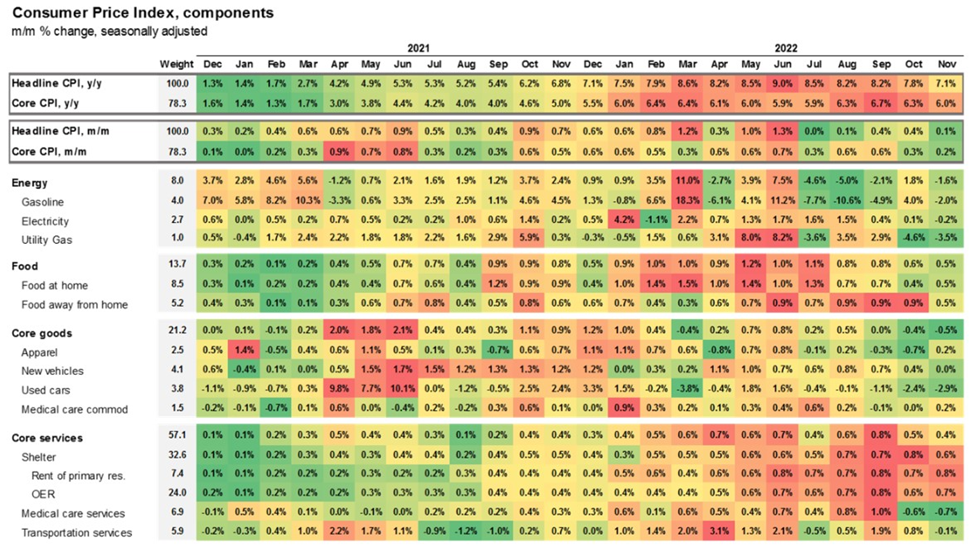

Inflation remains a concern, but the good news is that inflation is already slowing down and all 4 major categories of the consumer price index (CPI) have already experienced an inflation spike.

The 4 categories (energy, food, core goods and core services) are broken out in the table below along with the overall headline CPI changes (summarized in the top row):

.

.

The timeline of the inflation spikes does tell a bit of a story.

Core goods had the initial spike, which occured as supply chains were disrupted from Covid shutdowns. Then we saw another big spike in energy and food costs as the global economy cut off trade with Russia. And finally, shelter costs have lagged with their adjustments, which is typical.

There’s no crystal ball, but this story does offer some hope that inflation is cooling off. The headline CPI didn’t get much reprieve as all 4 CPI categories experienced spikes one after another. But now we can see that the headline CPI figure has been coming down and signs point to a continued cooling.

.

Interest Rate Policies

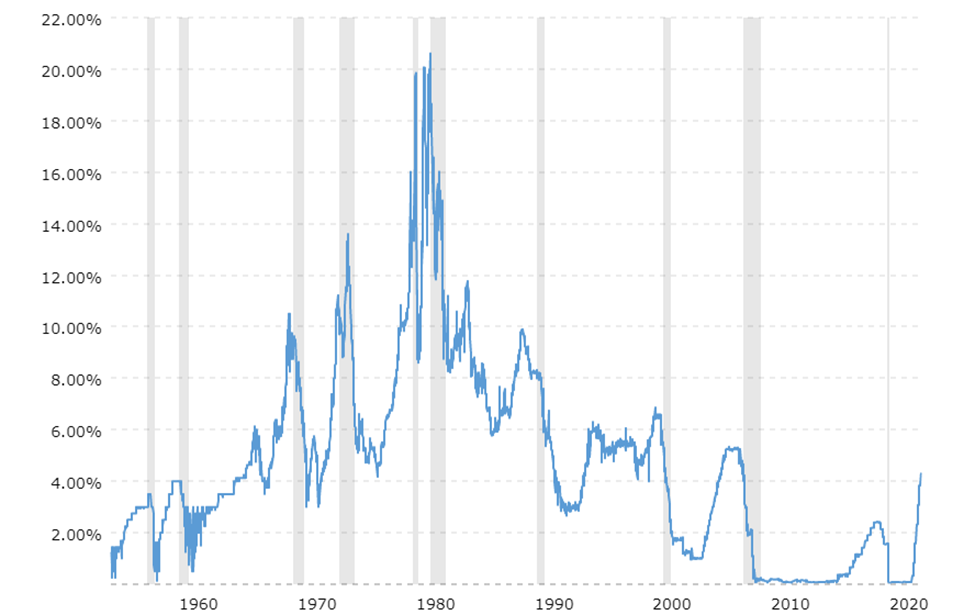

As we face a year of potential shifting monetary policy, it’s worth noting that the Federal Reserve hasn’t previously kept rates at their peak for very long. In fact, they have already indicated a likely rate decrease once inflation is under control.

This is important to note in case an investor is wanting to capture high income paying investments. Rates may not stay high for long.

This approach to overshoot rate hikes to then lower rates however can lead to volatile spikes until the economy normalizes. If rates are brought down too quickly, the Fed may have to revert back to raising rates again.

Time will tell, but this is worth noting to set our expectations in case this does play out.

Interest rates can change investment approach, housing prices, financing costs, asset valuations, etc. and markets like stability. So let’s hope we can effectively transition to lower interest rates, but we should also prepare ourselves for potential volatility in the near term.

The chart below illustrates the federal funds rate changes since 1954 (grey shading represents recessions):

.

https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

.

Global Diversification

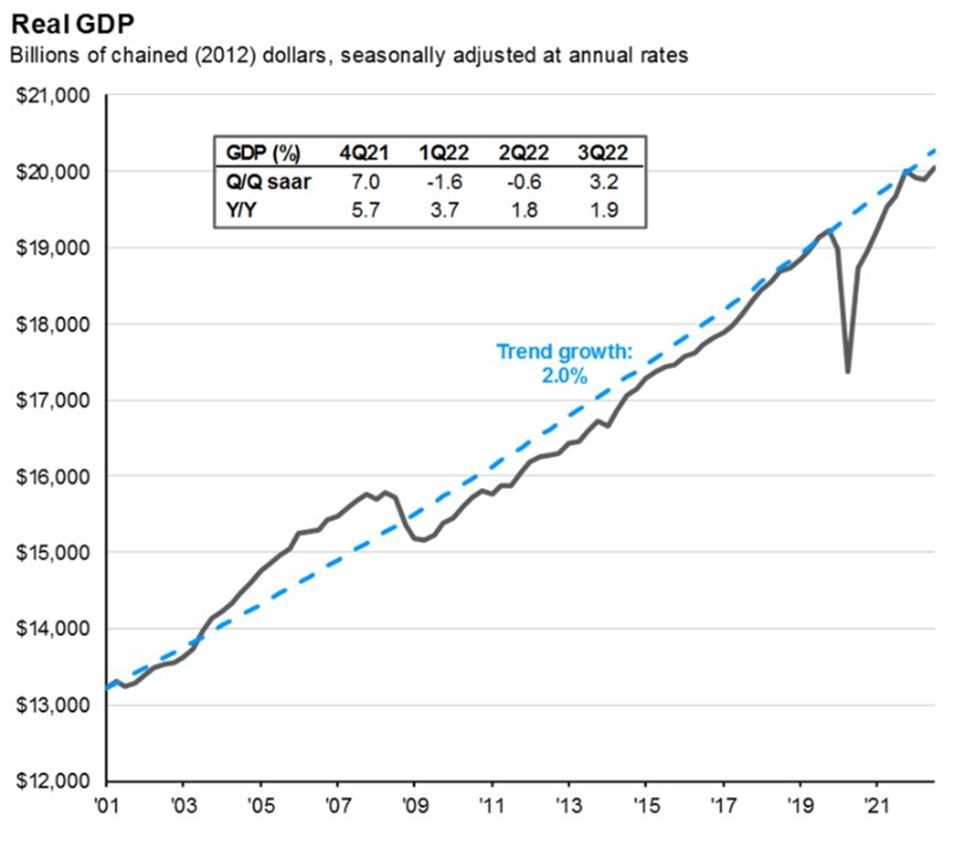

The US real GDP has rebounded from it’s pandemic dip and is back on it’s 20 year trend line of 2% annualized growth. Until innovation or demographics change, US economic growth is expected to continue at this slower relative rate.

.

Guide to the Markets – U.S. Data are as of December 31, 2022.

.

The expected slowing of the US economy paired with the relative attractive valuations of international equity markets makes a tilt towards international equity even more attractive.

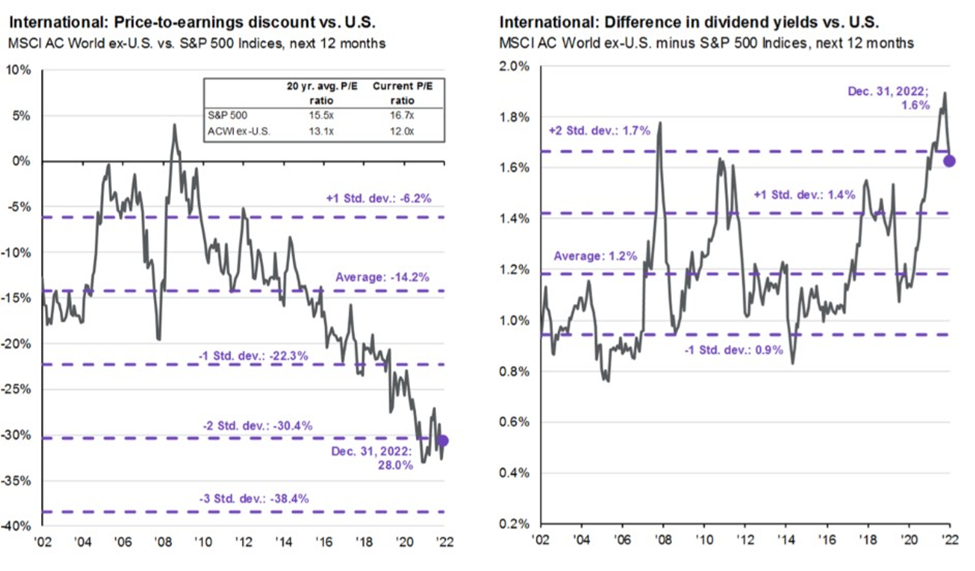

Below, the chart on the left illustrates the relative valuation of international vs US equity P/E (price to earnings) and the chart on the right illustrates the difference in dividend yields of international and US equities.

.

.

As you can see, international equities are not only more attractive from a relative valuation standpoint but they are also paying out a higher dividend yield, adding to the argument for an international equity tilt.

.

Rebound of Down Markets

As we navigate down markets, it’s important that we don’t forget the power of up markets.

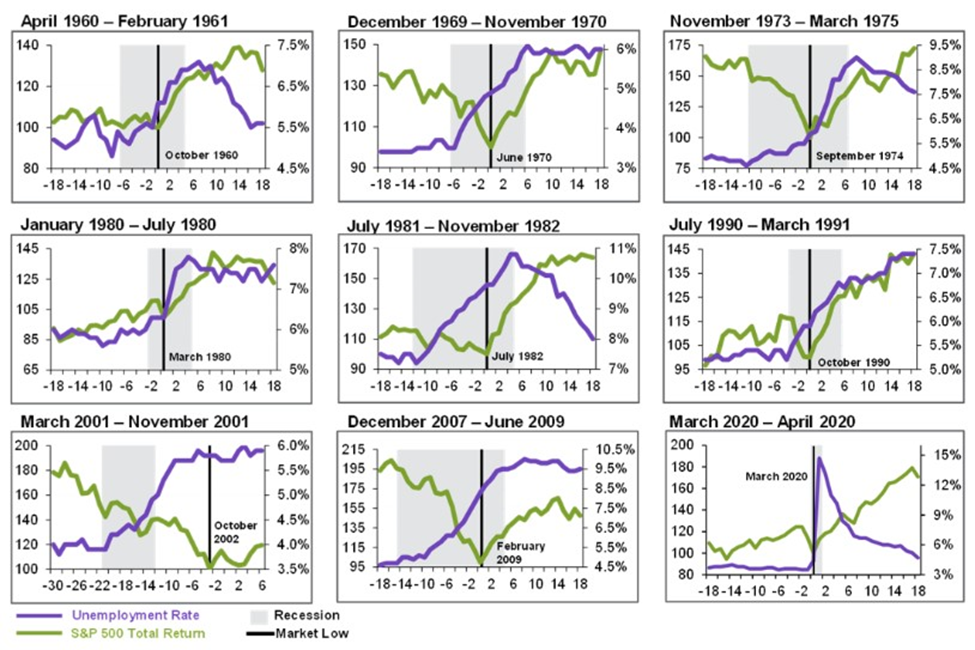

It’s also important to remind ourselves that markets are forward looking and aren’t always rational. This means that markets can move unexpectedly, at any time. Market movement doesn’t wait for an announcement on the start or end of a recession to decide which way to move.

So instead of waiting for the perfect time to invest, we recommend continually investing with a well thought out, disciplined approach. When the market rebounds, those ongoing, smart investment decisions will pay off.

Below is a summary of previous recessions and their respective characteristics. You can see that market performance (green line) doesn’t consistently move in the same pattern:

.

Guide to the Markets – U.S. Data are as of December 31, 2022.

.

And finally, let’s not assume all market downturns (or recessions) are the same.

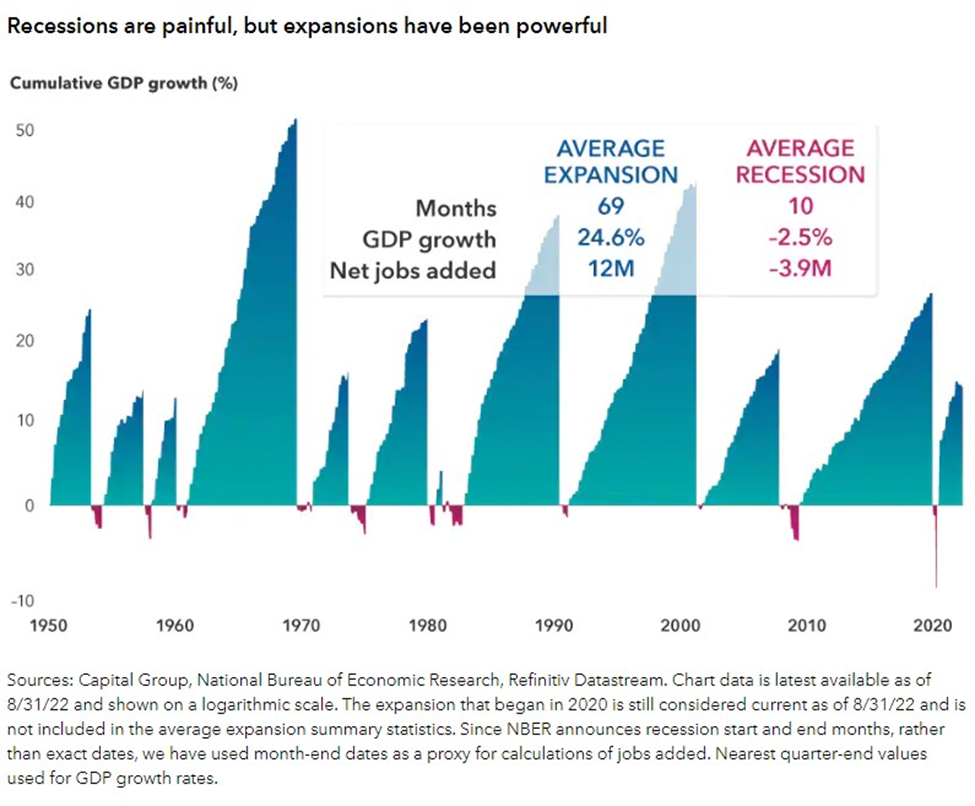

The term “recession” can sound scary. But as we see below, some recessions are relatively mild and the upside of growth has certainly surpassed the downside of recessions.

Down performance never feels good, but with the big picture in mind, we can see opportunity and the upside of down markets.

.

.

..

Takeaways

We are facing a number of significant shifts between our inflationary, interest rate and market environmnets.

Being positioned appropriately now will help ensure that you benefit when markets adjust accordingly.

Beyond portfolio decisions, planning should also be a focus to stress test your plan’s success with various market performance scenarios as well as finding additional opportunities beyond portfolio returns.

This is an important time to remember that smart financial decisions pay off over time.

.

Disclosures:

Commentary is provided only for informational purposes and should not be taken as investment advice. Commentary is general and investment advice should be unique to each individual. Please consult with a trusted advisor to receive advice specific to you.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Investment products are not FDIC Insured, bank guaranteed and may lose value.

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure.

January 10, 2023