Weathering Bank Failures and Economic “Breaks”

With 3 recent bank failures and more bank concerns on their heels, the consequences of raised interest rates are surfacing more and more.

The banks that failed (SVB, Signature and Silvergate) were relatively unique and in a riskier position than other banks, but without interest rate hikes, they may still be here today.

We know that interest rate hikes put stress on the economy. What we can’t always predict though is how the stress of these rate hikes will manifest and show up.

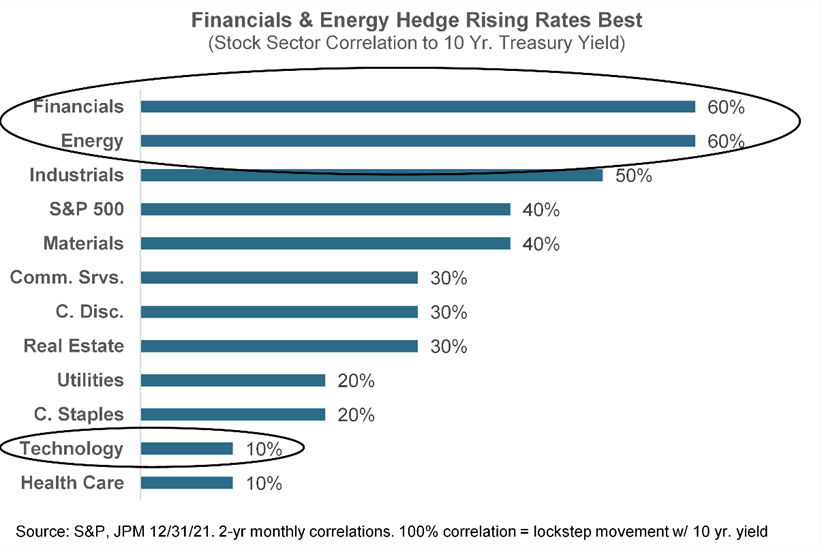

Contradictory to what we’re experiencing now, financials can often do well during rising rate environments. Banks can make more money off higher rates. This though assumes that banks are managing their interest rate risk and loan to deposit ratios appropriately, which the banks that failed were not.

As you can see, the financial sector often correlates with rising rates.

As rates continue to rise, there will continue to be added stress to the economy. We can try to predict where the next economic “break” will occur, but this is where diversification makes our jobs easy.

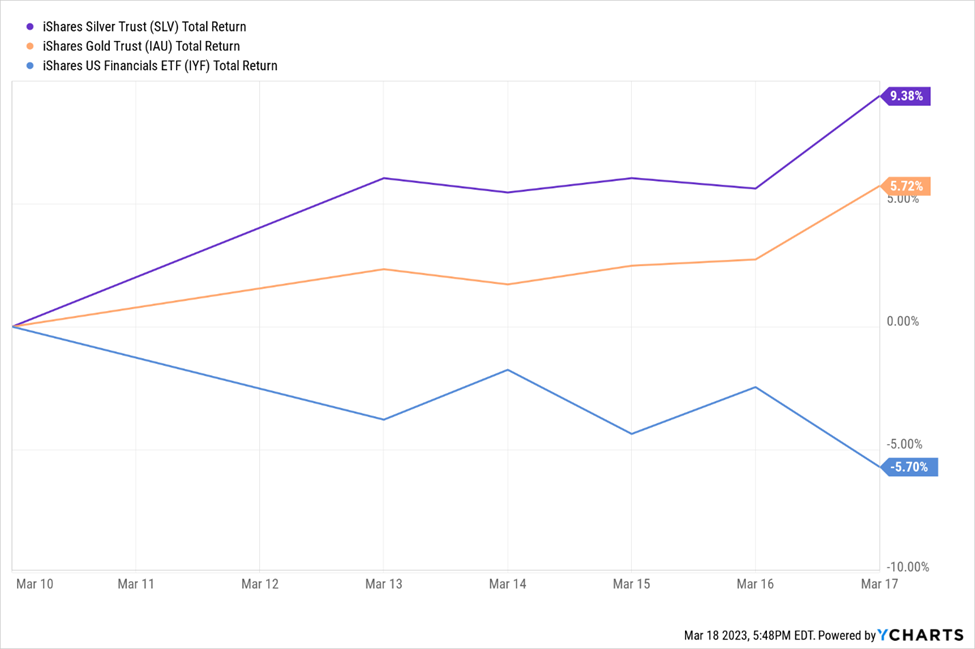

I don’t like looking at short term returns, but this last week (since the SVB failure) tells a story from a diversification point of view.

As we’d expect, financials (blue) have been down. And we can see silver (purple) and gold (gold) have been up. Things don’t always work out as we’d expect, but it’s nice when they do. We’re seeing one of the reasons why precious metals are a great diversifier in a portfolio while navigating economic headwinds. When investors are worried, they often move to defensive assets for security.

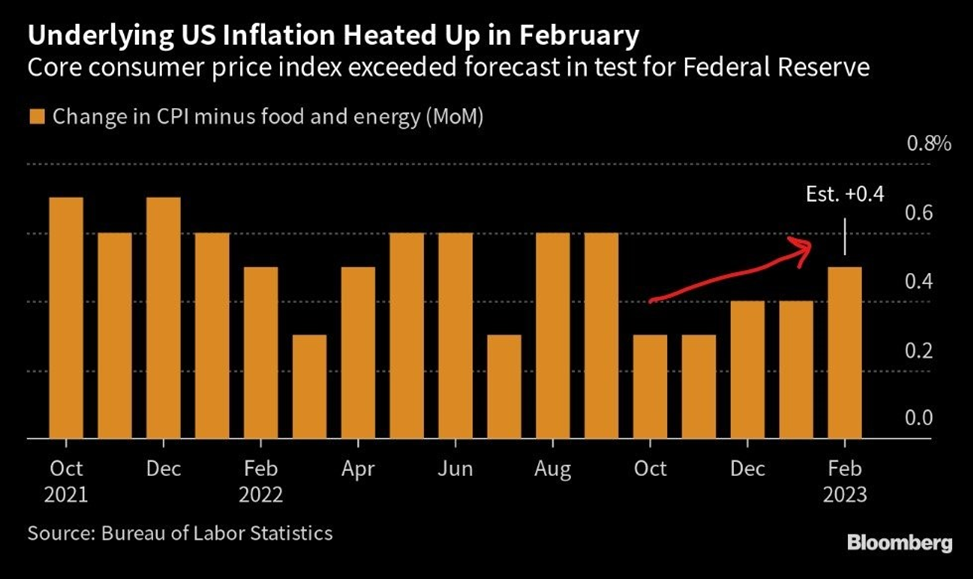

And with inflation still above its targets, we may very well be in store for more rate hikes and continued pressure on the economy. The SVB story stole the headlines last week, but February’s inflation number also came in and continues with the MoM (month on month) trend of increasing inflation since October.

Some are hoping the bank failures will give the Fed pause with their rate hikes. And it might start to slow them down, but with inflation still a concern, the Fed has plenty ammunition left to continue raising rates.

While the headlines of banks failing are worrisome, know this is why we diversify and have assets like precious metals in portfolios or other defensive positions like “buffered funds,” which protect against downside or very short-term bonds that have limited interest rate sensitivity. Diversification and exposure to these asset classes help portfolios weather the consequences of rising rates.

.

Disclosures:

Commentary is provided only for informational purposes and should not be taken as investment advice. Commentary is general and investment advice should be unique to each individual. Please consult with a trusted advisor to receive advice specific to you.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Investment products are not FDIC Insured, bank guaranteed and may lose value.

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure.

March 19, 2023