Russia/Ukraine Considerations

With the Russia/Ukraine conflict, we wanted to offer some considerations as we think of the implications of this war.

First and foremost though, we are still hopeful that there can be a peaceful resolution as soon as possible! War, economic struggle and lost lives are all terrible terrible things.

As we are experiencing though, the actions and reactions of countries are fairly unpredictable. The scenarios of how countries respond to one another could play out endlessly.

Given this unpredictability, the importance of a long-term, diversified approach is stressed even further. Diversification limits risk in a portfolio and can help reduce volatility. Consider a few examples of potential conflict and the various economic implications below:

Commodity Prices Increase

As we are already seeing, this conflict has the potential to increase the price of oil, gas and precious metals. This could very well continue, and depending on how everything plays out, this could be another cause for inflation. Higher costs would increases expenses for companies and may slow down consumer spending in the short run.

However, if inflation is sever enough, governments can change monetary and fiscal policies to combat inflation and/or to stimulate the economy.

We should also consider that while an increase in commodity prices would certainly have an impact on costs, we are less reliant on oil than we used to be.

Exposure to “alternative” investments like commodities could help stabilize your portfolio as commodity prices increase. Alternatives can also be a hedge to inflation and can protect against volatile stock markets.

Conflict Loses Steam/Stalls

While the current state is worrisome and it may be hard to imagine immediate peace, conflicts do lose steam and stall out. Let’s hope this is the scenario that plays out and if this does come true, market outlooks may remain some what unchanged still favoring international stocks, value stocks and investments positioned to handle rising interest rates.

Conflict Increases

If the conflict continues to increase, US markets could become more favorable than the current outlook and other “safe haven” investments could do well in the short term. Additionally, if the conflict and inflation increases enough, the government policy could shift from a current “tightening” approach to that of stimulating the economy again. This could keep interest rates low, which is different than our current outlook of rising rates.

Exposure to “safe haven” investments like US stocks and commodities may offer some support if this scenario plays out. International tilts may be stressed in this scenario, but international exposure along with a defensive position to rising interest rates may still be preferred as those are still favorable looking positions for a long term approach.

These are only a few scenarios and obviously we cannot predict how everything will play out. Hopefully though this helps illustrate how diversification can support your portfolio through various scenarios.

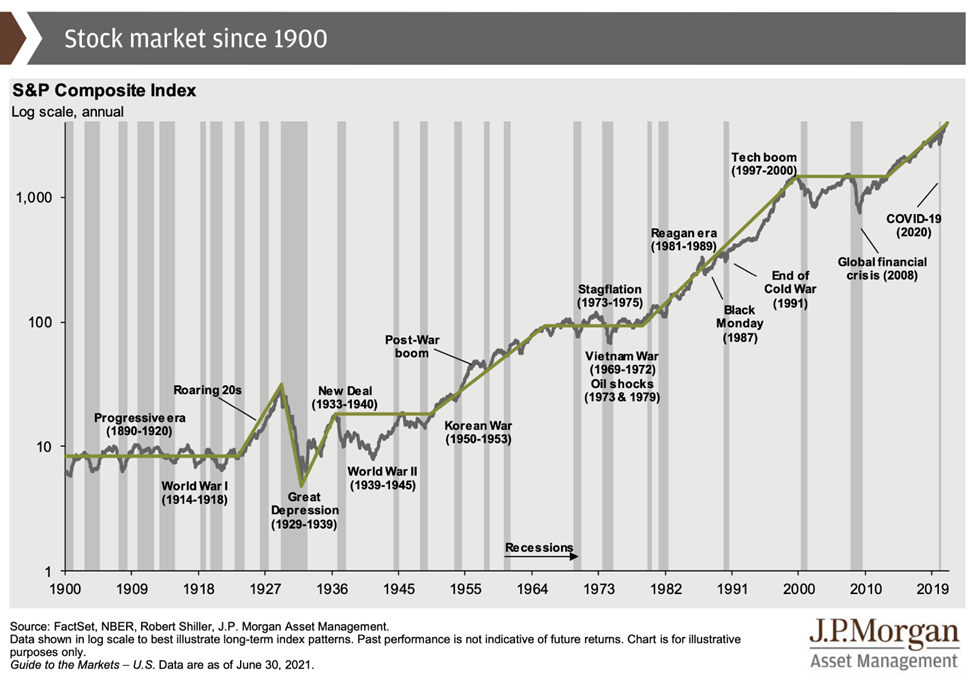

And not to neglect the short term scenarios, it is helpful to understand how scenarios may impact your portfolio, but it is also important to keep a longer term, bigger picture in mind as well. Take the chart below for example, illustrating the performance of the S&P 500 since1900 through other major global events:

As you can see, the market isn’t necessarily correlated to global events as you might think. Not indicated on this chart either is when Russia annexed Crimea in 2014, which was also an up year for the S&P 500. Markets have also historically had positive returns during times of war, which we hope to avoid of course, but it does offer context on market resiliency.

This isn’t to say that the current environment isn’t a concern. We have been facing a lot of uncertainties coming out of a Covid restricted economy already. Now adding a global conflict certainly represents more uncertainties and concerns, but during times of near term uncertainties, it is good to remind ourselves of time-tested investing principles like having a disciplined, long-term, diversified approach.

It is also a good time to remind ourselves of the importance of monitoring and adjusting/rebalancing as markets experience volatility. Investors sometimes trade one motion, and this can especially show over short time periods. If an investment becomes too over or undervalued or too over or under weight for your intended target, a readjustment maybe needed.

While hopeful that there can be peace between Russia, Ukraine and the rest of the world,

a globally diversified portfolio may help manage market volatility/risk and continuously monitoring your portfolio and the market landscape will be important in case any adjustments need to be made.

I hope this gives some helpful perspective.

Disclosure:

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure. This article provides general information and should not be taken as advice or a specific recommendation. Please consult with a trusted advisor to receive advice specific to you.

February 21, 2022