Lessons from 2022 & Pandemic Performance

2022 wasn’t all bad. We had the Winter Olympics, the US officially leaves the pandemic phase of Covid, NASA successfully completed the Double Asteroid Redirection Test (DART).

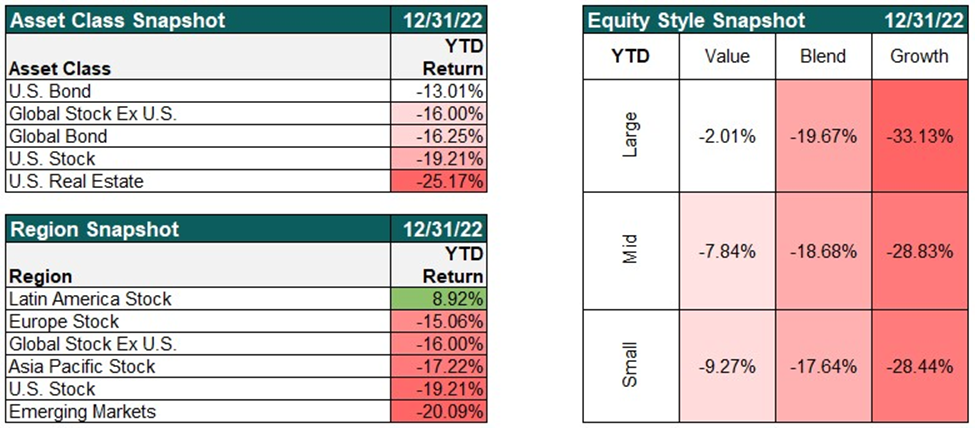

For financial markets however, it’s a bit harder to find a silver lining (although silver was positive for the year – I couldn’t resist). The tables below summarize 2022 returns:

.

.

As I alluded to with my silver pun, some commodities did end up positive for the year (silver, nickel, grains, livestock & energy to name a few), which are not summarized above. But it’s expected that most portfolios ended negative for the year.

While negative performance never feels good, a 1-year timeline often skews the long-term picture. I have the same summary below on a 3-year timeline:

.

*returns are annualized

.

A mixed bag of positives and negatives here, but the performance above is still fairly remarkable considering 2020-2022 included a global pandemic, a 2.78% rate increase on the Federal Funds Rate and a 13.08% increase in the US Consumer Price Index (or a common gauge of inflation).

As we reflect, this 3-year timeline really captures a lot of changes. While we could analyze historical performance to no end, this simple 1-year to 3-year comparison gives some great takeaways:

- Performance tends to normalize over longer time periods.

- Our memories can be pretty short. It’s hard enough to remember the Olympics at the beginning of the year, let alone 3 years’ worth of information.

- Stories about long-term performance don’t seem to make headlines like short-term performance does.

- The media is in the business of selling media, not in the business of giving financial advice. Stories about short term performance/outlooks and volatile swings in performance seem to catch more eyeballs than stories about disciplined, long-term investing that pays off over time.

- Looking at performance over a longer time period helps remove emotion.

- Returns normalize over time. If you are focused on year-to-year performance though, your emotions may never “normalize.” You may feel depressed after a down market, exhilarated from a great year, FOMO if your friend touts a perfectly timed investment (but of course leaves out the losses), etc. A long-term focus though will help reduce these emotional swings, making for a better investment experience.

An annualized 7% return of a US stock portfolio isn’t something that sells media stories or gets a lot of interest at cocktail parties, but that is the end result of the rollercoaster that the last 3 years has been.

This hopefully give some comfort as we navigate negative returns and as we look forward. Keep in mind that crazy, unexpected things will continue to happen. Short term events and performance will be the media’s focus and talked about at parties. Over time though, returns normalize and a disciplined, long-term approach pays off.

.

.

Disclosures:

Commentary is provided only for informational purposes and should not be taken as investment advice. Commentary is general and investment advice should be unique to each individual. Please consult with a trusted advisor to receive advice specific to you.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Investment products are not FDIC Insured, bank guaranteed and may lose value.

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure.

Y Chart Source Data is based off of the following indices:

Asset Class:

US Stock – Russell 3000 Total Return, Global Stock Ex US – MSCI ACWI Ex USA Net Total Return, US Bond – Bloomberg US Aggregate, Global Bond – Bloomberg Global Aggregate, US Real Estate – Dow Jones US Real Estate Index Total Return

Regions:

US Stock – Russell 3000 Total Return, Global Stock Ex US – MSCI Ex USA Net Total Return, Emerging Markets – MSCI Emerging Markets Net Total Return, Europe Stock – MSCI Europe Net Total Return, Asia Pacific Stock – MSCI AC Asia Pacific Net Total Return, Latin America Stock – MSCI Emerging Markets Latin America Net Total Return

Equity Styles:

Large Growth – CRSP US Large Cap Growth Index Total Return. Large Blend – CRSP US Large Cap Index Total Return, Large Value – CRSP US Large Cap Value Index Total Return, Mid Growth – CRSP US Mid Cap Growth Index Total Return, Mid Blend – CRSP US Mid Cap Index Total Return, Mid Value – CRSP US Mid Cap Value Index Total Return, Small Growth – CRSP US Small Cap Growth Index Total Return, Small Blend – CRSP US Small Cap Index Total Return, Small Value – CRSP US Small Cap Value Index Total Return

January 9, 2023