May Market Update

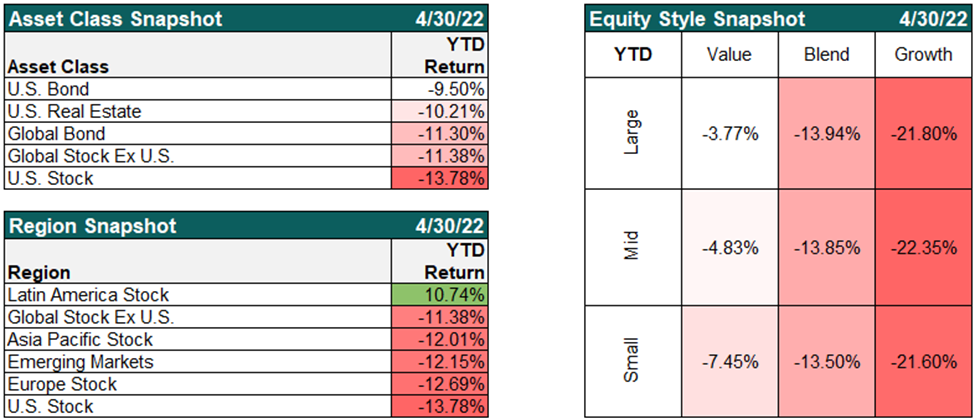

As we’re experiencing, stock markets are having a rough start to the year. And there haven’t been many places to hide as the tables below show.

*Source – Y Charts Market Update Data – Year to Date Performance (1/1/2022-4/30/2022)

Why are markets down?

There are a number of reasons for this negative performance.

- Stock prices were already well above historic valuations coming into the year. Some of this correction could be a return to more typical valuations.

- Inflation

- Governments around the world pumped a lot of money into the global economy through the Covid pandemic. The aftermath of this though has led inflation.

- The war in Ukraine has increased oil and commodity prices, also contributing to inflation.

- Inflation can have a mixed impact on the market but as costs rise, company profits can take a hit, consumers can spend less and investors can become concerned about the steps that will be needed to slow down inflation which can slow down the economy and company profits. There are many aspects to market performance and many of the variables are tied together, but inflation has certainly been part of the story so far in 2022.

- Interest Rate Increases

- To combat inflation, governments are increasing interest rates. The implications of rate changes are varied but for now, markets haven’t reacted well. For one, rising rates are a way for governments to slow down an economy, which investors don’t take kindly to. In addition to a potential economic slow down, stocks are also often valued using a “discounted cash flow” valuation method. Of course at the end of the day, a stock is only worth what someone is willing to pay for it, but without going down the rabbit hole of various valuation methods, rising rates reduce the “present value” or valuation of a stock when using this common “discounted cash flow” valuation method.

- War in Ukraine

- As mentioned above, the war in Ukraine has led to higher costs in the global economy. And of course there are countries and industries that are being directly impacted by this war.

- Covid Shut Downs in China

- With China’s “zero tolerance” Covid policy, a major global economy has been slowed down. This of course effects Asian markets but given how globalized our economy is, China’s shut down also impacts global markets as a whole.

- Uncertainty

- Stock markets don’t typically respond well to uncertainties and there are a lot of uncertainties right now. How long will the war in Ukraine last and how devastating will it become? How high will interest rate hikes go? And will the rate hikes be enough to control inflation or will inflation run off? These uncertainties all lead to volatility in the market.

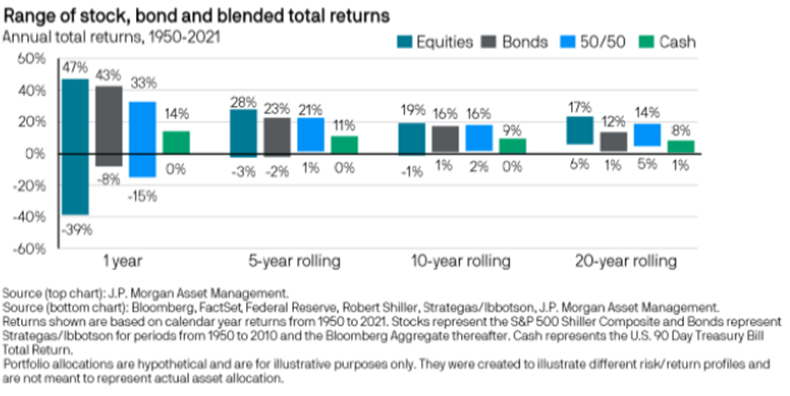

While this may paint a depressing picture, I will remind you of the resiliency of markets. Take the chart below for example:

As you can see, there has been a much wider variance of returns over shorter periods of time and returns have been positive for every category over the 20-year time period.

So yes, that may be the anticipated “stay the course”, it’s a long-term approach, piece of advice, but reminders can be helpful during times of negative performance.

And there are some items we can remain hopeful about in the short-mid term outlook as well.

The optimistic flip side

Pent Up Demand

There is still pent up demand in the economy. Society is still slowly opening back up from Covid shut downs and as we continue to get through Covid variants, we should see more economic activity.

Additionally, businesses are trying to hire but unemployment has been at very low levels. Available jobs are at historically high levels. People haven’t been able to buy new vehicles because of lack of inventory. Housing supply isn’t meeting demand. The list could go on of supply issues. Fortunately though, the economy and free markets have a way of resolving issues like this. As new homes, vehicles and workers enter the economy, we would expect economic growth accordingly.

Things Change

The other positive note to add is that things change. China will eventually come out of their Covid lock down. The global economy will adjust to the war in Ukraine. Let’s hope and pray for an end as soon as possible, but until then, the economy will adjust. We will look for alternative energy and commodity solutions to help with rising costs. Right now we are in a rising interest rate environment. As inflation calms down, rate hikes should as well. As this happens and as uncertainties go away, the markets could react positively.

What to do?

Of course there is no simple answer for investing. There are areas of concern but it’s not all doom and gloom. As we navigate the considerations laid out above, we have a few areas of focus on our minds for you and your portfolios.

- Ensure that your portfolio is aligned with your comfort

- We could be facing more negative performance ahead. Many of the factors that have contributed to negative performance so far in 2022 are still here and we are still seeing how everything plays out. If you don’t think you can stomach further negative performance, you may need to adjust to a more conservative portfolio.

- Down markets can represent opportunity

- If it helps you feel better about down markets, savings now are able to buy more shares for the same dollar amount. Back to the long term approach, you may be selling investments 10-20 years from now. If markets will be up 10-20 years from now, you will want to buy in with as much of a discount to that future value. So short term swings down in the market can represent good buying opportunities.

- If you want to get into the market but are concerned about further market declines, you could split up your investments and invest a portion now, and invest the remaining portions over time. Or to use industry lingo, “dollar cost average” into the market.

- Rebalancing

- Volatility and market movement represents opportunity to rebalance your portfolio. If a portion of your portfolio has a relatively larger decrease than the rest, this may be an opportunity to sell what is up and buy what has gone down. Or another opportunity during down markets is to sell positions that no longer have a taxable gain or may even have a taxable loss. This is helpful to sell out of positions that may not be a fit but were held onto for tax reasons, or to realize losses that offset income come tax filing time.

- Allocation Considerations

- Diversification remains key. With so many uncertainties, a diversified approach helps provide for a smoother ride. Alternatives continue to remain a key part of this diversification. Although the landscape is changing, equities may still experience further negative returns and income investments may not be providing enough income quite yet and will experience negative performance as interest rates rise. Alternatives offer additional diversification from a typical stock/bond allocation.

- International equities continue to have better relative valuations than US equities. International equity performance may have been held back this year given the war in Ukraine and a Covid shut down in China. We continue to see opportunity in a tilt towards international equity exposure. This may represent some additional volatility, but down turns in the market could continue to offer opportunity.

- Value stocks are proving to outperform so far in 2022. Although negative, value stocks have been down much less than growth stocks. Value tends to do well during times of inflation and growth stocks have had much higher relative valuations and still continue to. We continue to see value stocks as a tilt for opportunity.

- As interest rates continue to rise, income investments will become more attractive. This will be for higher income distributions but also because the risk of future rate increases may decrease as well. As rate increases tail off, risk in income investments will be reduced since rate increases negatively effect the price/value of income investments.

So while 2022 has been off to a down start and there are still future uncertainties, there are still a lot of opportunities and reasons to be optimistic for your long term investments.

Of course each investor is unique and no investment change should be solely based off of this commentary. Please reach out to your advisor if you would like to further discuss your portfolio and your appropriate strategy.

Disclosures:

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure. This article provides general information and should not be taken as advice or a specific recommendation. Please consult with a trusted advisor to receive advice specific to you.

Y Chart Source Data is based off of the following indices:

Asset Class:

US Stock – Russell 3000 Total Return, Global Stock Ex US – MSCI ACWI Ex USA Net Total Return, US Bond – Bloomberg US Aggregate, Global Bond – Bloomberg Global Aggregate, US Real Estate – Dow Jones US Real Estate Index Total Return

Regions:

US Stock – Russell 3000 Total Return, Global Stock Ex US – MSCI Ex USA Net Total Return, Emerging Markets – MSCI Emerging Markets Net Total Return, Europe Stock – MSCI Europe Net Total Return, Asia Pacific Stock – MSCI AC Asia Pacific Net Total Return, Latin America Stock – MSCI Emerging Markets Latin America Net Total Return

Equity Styles:

Large Growth – CRSP US Large Cap Growth Index Total Return. Large Blend – CRSP US Large Cap Index Total Return, Large Value – CRSP US Large Cap Value Index Total Return, Mid Growth – CRSP US Mid Cap Growth Index Total Return, Mid Blend – CRSP US Mid Cap Index Total Return, Mid Value – CRSP US Mid Cap Value Index Total Return, Small Growth – CRSP US Small Cap Growth Index Total Return, Small Blend – CRSP US Small Cap Index Total Return, Small Value – CRSP US Small Cap Value Index Total Return

May 4, 2022