“The chances of a soft landing are likely to diminish.”

Another .75% rate hike was announced by the Federal Reserve (on 9.21.22) and another .75% rate hike is still expected before year end. Beyond the rate raises, Jerome Powell’s words have remained very “hawkish” (or focused on limiting inflation and committed to raising interest rates), which continues to caution investors on what’s to come.

Below are a few excerpts from Powell’s comments:

“…the chances of a soft landing are likely to diminish…Nonetheless, we’re committed to getting inflation back to 2%…”

“…we have to get inflation behind us. I wish there was a painless way to do that, there isn’t.”

These comments not only acknowledge the economic hardship brought on by higher interest rates, but Powell is telling us that even if the economy is struggling, he and the committee are prepared to continue raising rates until inflation comes down.

The scenarios on what could happen are limitless, but investors should take caution when the Fed makes especially hawkish comments like these. Rising interest rates hurt company profits and ultimately stock prices.

Haven’t we already had a correction?

2022 has been a down year so far, but this has largely been due to “multiple compression” – or how much investors are willing to pay for a stock relative to expected earnings/revenues. This multiple has been decreasing throughout the year as future expectations are changing. Revenues however, have been relatively stable. But as interest rates continue to rise, revenue expectations will continue to decrease.

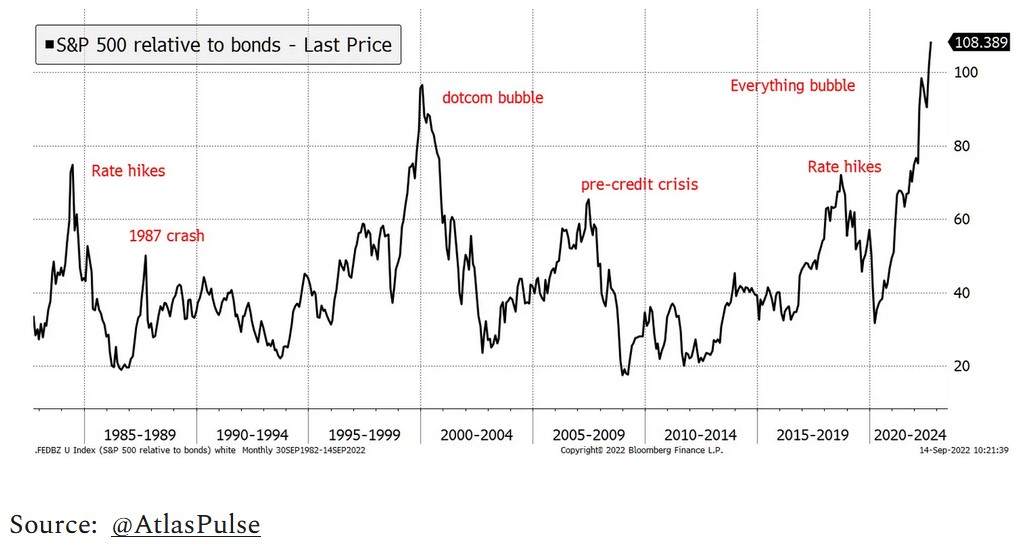

To help illustrate the impact of rising rates and what previous revenue cycles have looked like, see the charts below:

As you can see, rate hikes have previously resulted in a relative decrease in stock prices and it appears as though we are at a potential revenue cycle peak. So even though we have had a down year so far, there are still potential pressures for future negative performance. And these downward pressures grow as interest rates rise.

Of course, there is always a flip side to the coin. Raising rates and getting inflation under control is helpful for future long-term growth. And there are variables that are hard to predict like the war in Ukraine, oil prices and how quickly consumer spending will slow down.

This also isn’t all “doom and gloom”. There are ways to protect against risks and there are always opportunities. We will continue to help clients position appropriately but it is worth understanding the potential risks and preparing oneself mentally for what could happen. We want to help you avoid any emotional trading.

Emotional Trading

Letting emotions control investment decisions can detract from returns in a large way. When others trade on emotion however, it can present opportunities for the diligent investor. The challenge is to stay diligent and to tune out other investor’s emotions.

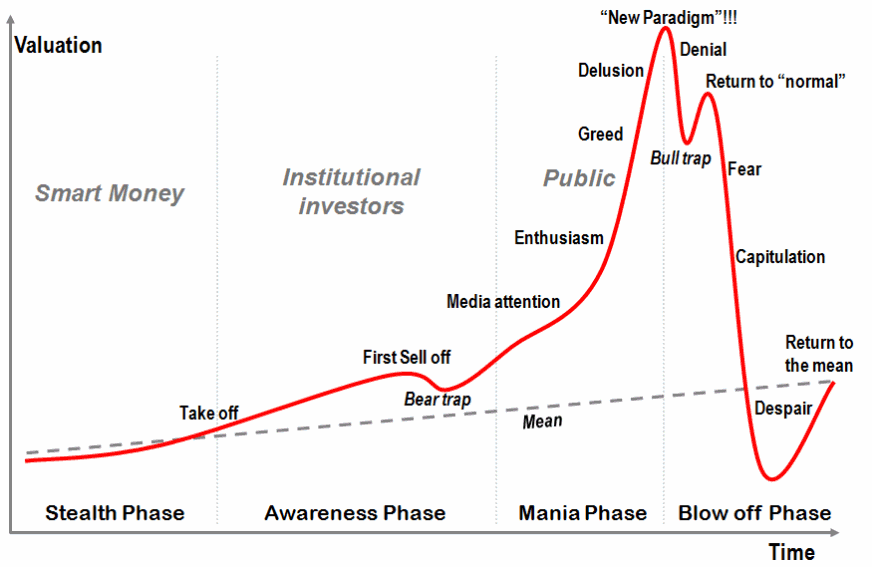

Consider the chart below and how you might react as investments move along the different stages (also notice the sections of smart money & institutional investors vs. public emotion):

Emotional trading

This is just a hypothetical example, but as the chairman of the FOMC (Federal Open Markets Committee) tells people that a “smooth landing” is becoming less likely, thinking about how emotions can drive markets is a helpful exercise. Investment prices don’t always follow reason. Fortunately, emotional swings sort out over longer periods. Being diligent pays off over time, but it’s important to be in a portfolio that you will feel comfortable with during downswings, to prevent emotional trading of your own.

We will continue to help clients optimize and balance their portfolios, but if you have any concerns or would like to discuss your risk-return objectives, please contact us to further discuss.

Disclosures:

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure. This article provides general information and should not be taken as advice or a specific recommendation. Please consult with a trusted advisor to receive advice specific to you.

September 24, 2022