No Child Tax Credits? What If You File Separate?

As parents are likely aware, part of the American Rescue Plan stimulus increased child tax credit amounts in 2021. But with income limits to qualify for these credits, many high earning families did not receive any advanced credit payments and may be assuming they just don’t qualify.

This however may not necessarily be the case.

If majority of household income is coming from only one spouse, couples may find that a “married filing separate” tax filing status qualifies them for a substantial child tax credit.

How the (2021) Child Tax Credit Works

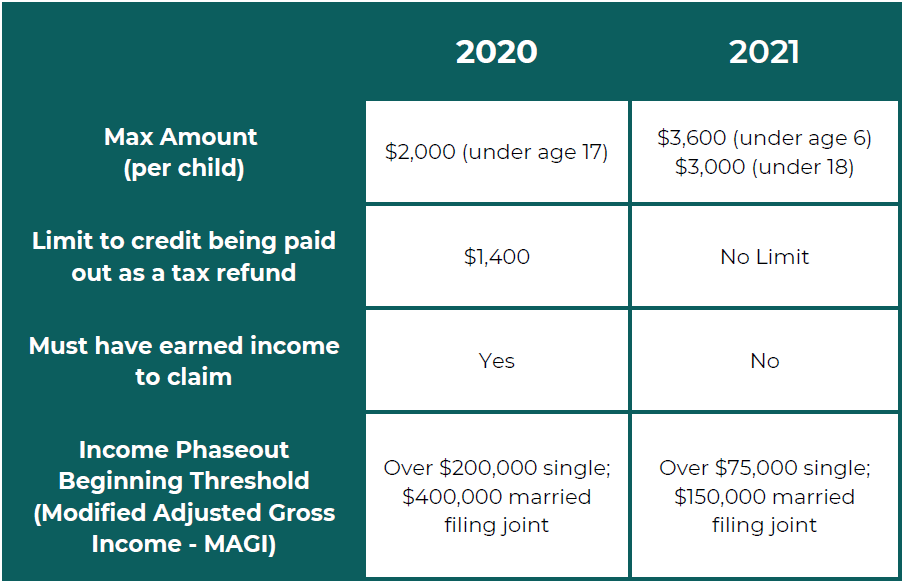

First let’s take a look at how the child tax credit works and what changes occurred, creating this unique opportunity:

The Strategy for High-Income Families

The scenarios can get complicated with phase outs and other considerations but to illustrate a potential strategy, let’s assume a family receives no child tax credit filing joint. But one spouse has income (MAGI) under $75,000, if filing separate. Let’s also assume the couple has 3children, 2 under the age of 6 and 1 child over the age of 6.

In this example, the spouse with the lower income could file separately and receive a tax credit of $10,200 that the couple would otherwise not receive! This is even the case if the spouse didn’t have earned income and even if the credit is paid back as a refund! This is a substantial potential benefit for this year’s tax filing.

Of course there are many variables and each situation is unique. For a few key points on this strategy, consider the following:

- The more children you have, the more valuable this strategy could potentially be.

- Even if a spouse has zero earned income, the spouse can still file separate and receive the full credit as a refund.

- If you received payments but they were phased out, this could still be a strategy to receive the full amounts.

- Even if the lower earning spouse has income above $75,000, this could be worthwhile to look into, if there is a wide variance of income. The lower income spouse may have much less of a phase out.

Is There a Catch?

Maybe, but not necessarily, and it may still be worth it.

The biggest catch is if you live in a community property state. If you do, this strategy likely won’t work since you have to report half of your spouse’s income. I wish I had better news for you. Maybe we can help you find another tax strategy!

Married filing separate does have several other nuances that should be considered. The list of nuances is too long for this article but as a high-level summary, many disadvantages of filing separate are related to losing the ability to take various deductions, credits and tax benefits that you may qualify for when filing jointly.

This point may be mute though since a couple that has income too high for child tax credits may very well have income too high for a lot of the tax benefits of filing joint anyways! As high-income earners are likely well aware, there other tax advantages besides the child tax credit that are also phased out once your income is high enough.

And even if filing separate restricts you from taking a deduction, it might be outweighed by the substantial credit that you would receive!

Between nuances of filing separate though and the various phase out levels, this strategy can quickly have layers of complexity. If you think you might qualify for this or would like a second opinion on your tax credit potential, we recommend consulting with a tax professional to fully analyze your specific situation.

The Takeaway?

If you have several children, received no or limited child tax credits in 2021 and have a disparity in income between you and your spouse, consult with a tax professional to see if “married filing separate” qualifies you for a substantial 2021 child tax credit.

Disclosure:

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure. This article provides general information and should not be taken as advice or a specific recommendation. Please consult with a trusted advisor to receive advice specific to you.

March 2, 2022