Are You Invested in Fossil Fuels?

With Earth Day upon us, we wanted to offer a few thoughts on fossil fuel exposure your investments may have and the impact of di-vesting from those fossil fuel investments.

Do you own fossil fuel investments?

If you haven’t consciously constructed your portfolio to be an eco-friendly portfolio, you likely have money invested into oil, gas and coal. Take IVV for example, which is an S&P 500 index fund. This fund has an 8.56% exposure to fossil fuel stocks, or $28.51 BILLION invested across 51 fossil fuel equity holdings. *

This example is helpful as the S&P 500 is such a common investment but of course each investment and portfolio will be unique.

Does “going green” hurt performance?

Some may feel that “going green” will hurt performance. They may feel that exposure to oil helps provide extra return.

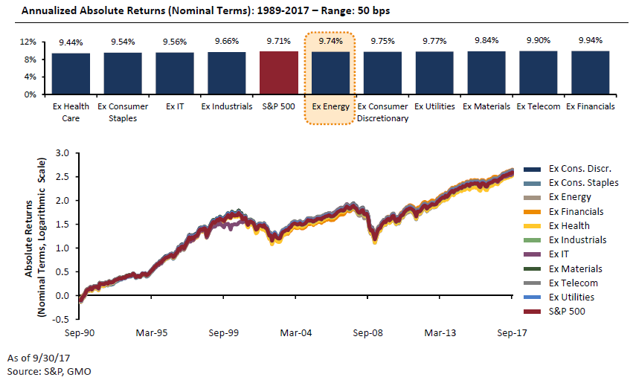

Of course each investor’s goals and needs are unique. And no one can predict future performance. But it is interesting to see the historical impact of removing the energy sector, or any other sector for that matter, from the S&P 500 index. The table below illustrates just that from 1989-2017 (September).

There are many considerations when analyzing investment returns or the potential for returns. But one of those considerations is as simple as economic growth. Of course we are seeking a better than average return, but one could argue that many sectors will appreciate along with economic growth. Or to use the common aphorism, “a rising tide lifts all boats”. This isn’t always the case and over simplifies things a bit. There are areas that you may want to tilt towards or away from for potentially higher returns, but this does help illustrates that you may not necessarily need to give up on expected return when excluding a sector, company, etc. that you do not agree with.

What’s the impact?

Well this is another typical answer in investing, it depends. But I can tell you that technology and reporting standards have gotten much much better over the years and we are able to dig into this answer much better than we used to.

Technology allows us to collect and analyze a lot of data anymore. This isn’t necessarily new, but combined with more reporting standards for companies, the investment world is getting much more efficient at reporting on company fossil fuel usage, gender of board members, lawsuit claims against companies, etc. etc.

For an example output of an “impact report” that we can generate, see the screen shots below:

The results of course will vary for each portfolio, but “going green” with your investments and aligning your money to your values has become much easier than it used to be.

If you would like a free assessment of your current investments and how a potentially “greener” portfolio would compare, please send us a message or give us a call. Or, start with our “Values Discovery Quiz“.

*Data as of 3/30/2022 from fossilfreefunds.org

Disclosure:

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure. This article provides general information and should not be taken as advice or a specific recommendation. Past performance is not indicative of future returns and should not be construed as indicating this. “Green” or “going green” only indicate potential environmental impacts and do not indicate any investment return outcomes. Please consult with a trusted advisor to receive advice specific to you.

April 22, 2022