Top 5 Financial Planning Considerations for 2022

As we continue to adjust and hope for a “normal” year after this global pandemic, let’s not assume that our economic conditions will also shift to “normal” status.

There are some unique financial circumstances at the moment, which should be considered as you think about your finances for 2022.

Rethink Diversification

Diversification continues to be tricky as stock prices remain at historic highs and interest rates remain at historic lows.

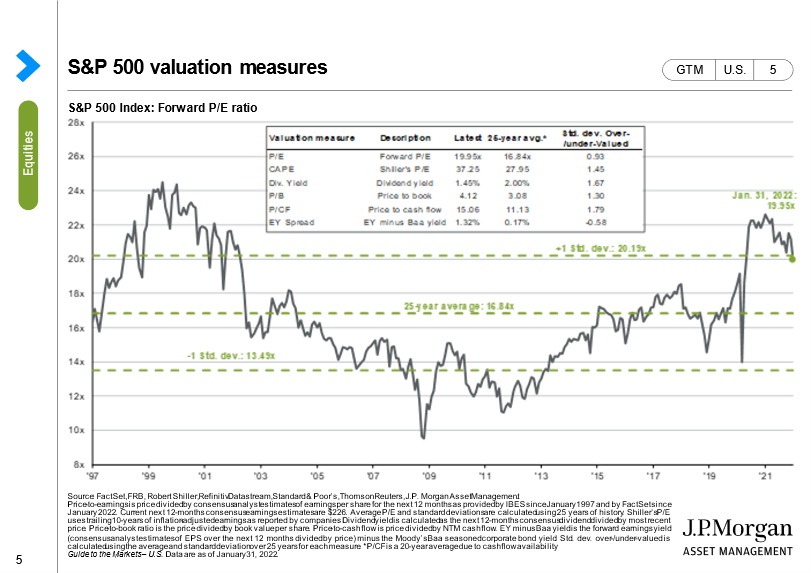

As the chart below illustrates, even with the recent market downturn, the S&P 500 forward P/E (price/earnings) ratio continues to be over its historic average (nearly +1 standard deviation). You can also see the last time forward P/E ratios were at our current levels, there was a corrective slide for a number of years.

While no ratio can completely predict future returns, P/E ratios are a great gauge of valuations to let us know if stocks are trading at a premium or a discount. And over longer periods of time, trends can be more predictive.

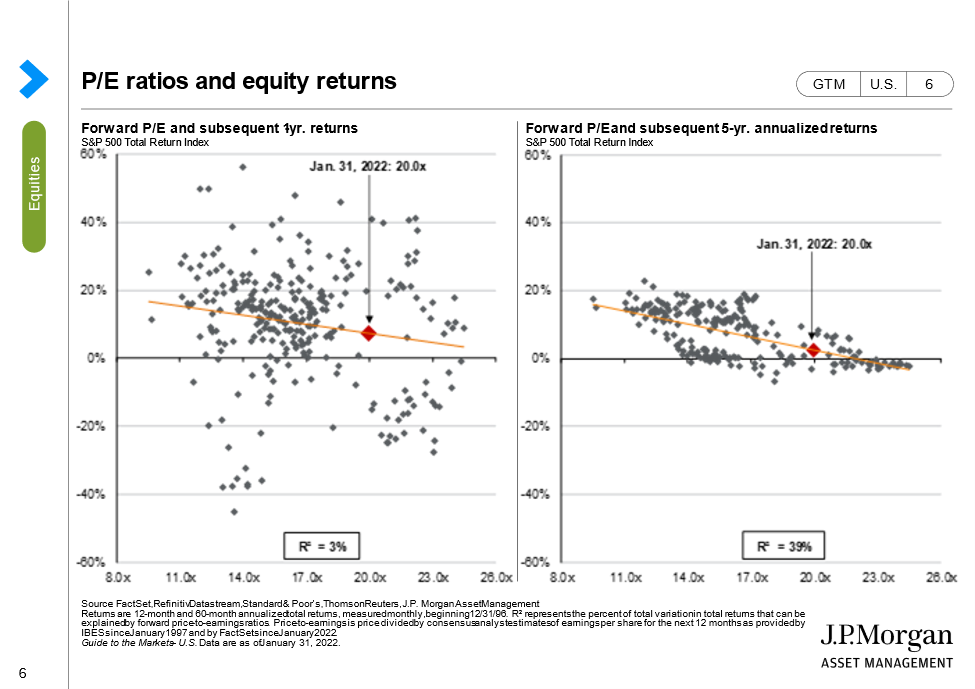

Take our next chart below for example, showing subsequent returns relative to forward P/E ratios. Over a 1-year period, returns have been fairly scattered along the trend line. Over a 5-year period however, returns have been much tighter along the trendline, indicating a more predictive measure over time.

As you can see, the higher the forward P/E ratios is (further to the right on the trend line), the more indicative it is of lower annualized returns.

To diversify against uncertainties in the equity markets, investors often turn to bonds. Bonds are typically much more stable and pay out income, helping a portfolio still earn something, while equity markets do their zigging and zagging.

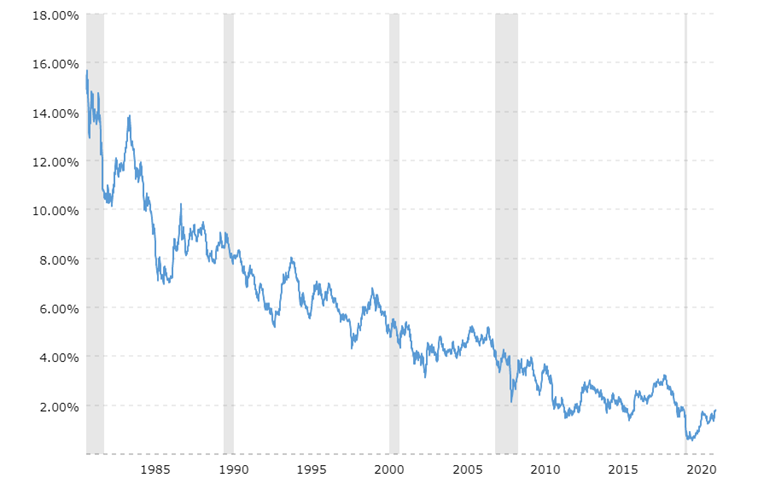

While bonds shouldn’t be completely written off, bonds have changed over the years. Take the chart below for example illustrating changes in the US 10-year treasury yield since September 1981.

US 10 Year Treasury Yields

Sept. 7, 1981 – Feb 3, 2022

As you can see yields/interest rates/the income you’d get from a 10 Year US Treasury has gone down over the years and has gone down substantially! Given our current historic low interest rates, bonds aren’t offering the same level of benefit to your portfolio as they once did. And to add to it, as interest rates rise, bond prices decrease. This adds another challenge to the fixed income portion of your portfolio.

So what is an investor to do? Well, diversification among equities and fixed income is still important. There may be equities with lower valuations or bonds with higher interest rates that are a fit for you. But, given our current environment, investors should also consider exposure to lessor known “alternatives” in their portfolios.

Alternatives are investments outside of typical stocks and bonds such as real estate, commodities, currencies, private investments, or financial contracts to name a few.

Alternatives are not created equally however and vary in their investment objectives from being more return seeking, income producing or focused on stability. Alternatives can require more research and due diligence than typical investments since they are unique and their reporting may be different than a publicly traded stock. Alternatives can also be tricky to access.

The trickiness in this space though may be a large part in why alternatives remain attractive and why they may not move in line with the rest of the market.

Take advantage of low rates and high valuations

Interest rates are still historically low but these rates may be increasing soon. Along with these low rates, valuations for property, businesses and other assets have increased.

This makes for an ideal environment for refinancing a home with not only low rates but also access to potentially more capital if your real estate value has increased.

For business owners, a business loan may be attractive with a relatively low rate allowing you to invest in your business. The interest payments may also be tax-deductible depending on how the loan is structured and utilized. Or if you are considering a business exit, you may receive a relatively high valuation given the current environment.

Shift to a Clean Economy

Regardless of political views on climate change, it should be noted that politicians around the world are discussing and implementing policy changes to shift to a climate friendly economy.

This shift presents both a risk and an opportunity. Some companies and investments are positioned to handle these changes better than others. A challenge to be aware of however is that the news is out on the to shift to a clean economy. Clean technology investments benefitted from substantial price increases as policy changes were announced and as a result, many clean technology investments have very high valuations or are currently trading at a premium.

How your portfolio will handle these changes should be considered but be cautious jumping into environmental focused investments that may be trading at a premium. These could be attractive investments though if we experience a market correction.

Inflation and Rising Rates

The Federal Reserve (The Fed) is committed to reducing inflation as quickly as possible, and the first tool in the arsenal is to increase rates. The Fed has indicated they plan for multiple rate hikes over the coming years, which will directly impact everyone’s finances from a few different angles. From an investing standpoint, in addition to what we mentioned above, these are a few questions to ask yourself to understand the personal effects of inflation:

- Is your portfolio positioned for the double impact of inflation and rising rates? This could include reallocating and shifting investments to different sectors that are generally less affected by an inflationary environment and including investments that can mitigate the impact of rising rates, such as lower-duration bonds or floating rate notes.

- Do you need to make any adjustments now to ensure inflation doesn’t hurt your financial stability? Will your expenses or income be impacted by inflation? Should you prioritize savings now or adjust your savings to better handle inflation? Proactive planning is important in case adjustments are needed to maintain or strengthen your financial stability.

Don’t Forget About Tax Changes

The “Build Back Better” plan did not get passed in 2021 but that does not mean politicians are done talking about policy changes. Many of the items proposed are still on the minds of policy makers and may be implemented over time. If there were policy changes in the Build Back Better plan that concerned you, you may want to implement strategies now knowing that certain changes are on the minds of policy makers.

As a reminder, here are a few of the proposed changes from the bill:

| New caps on Itemized Deductions | Increased Ordinary Income Rates |

| Increased Capital Gains Rates | New tax for S Corp income & Retirement account distributions. |

| Changing Required Minimum Distribution rules from retirement accounts. | Prohibiting After-Tax IRA/Roth IRA conversions. |

| Limiting the QBI Deduction for business owners. | Restriction of private investments within an IRA. |

| New 5% Surtax for “ultra” high income earners – concerns for business or other large asset sales or “ultra” high income earners. | Wash sale rules applied to crypto and foreign currency. |

Also, don’t forget about the Tax Cut and Jobs Act (TCJA) expiration in 2025, which lead to a reduction in taxes for many. While this is still a few years away, it highlights the tax planning window we are in. There have been new proposals to increase taxes and there are tax increases if we revert back to our previous tax policy, which we are currently set to do.

Given these tax policy considerations, now seems to be a great time to refine your tax plan to see if there are any strategies to take advantage of before policy changes.

The Takeaway

Although a return to “normal” may be approaching, don’t assume financial conditions are “normal” as well.

We live in a time of unique economic conditions, and managing money is becoming increasingly difficult. With changing conditions though, there are opportunities as well as risks to be aware of.

If you would like to talk about how to prepare your finances for the future, please send us a message or set up a call.

Disclosure:

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure. This article provides general information and should not be taken as advice or a specific recommendation. Please consult with a trusted advisor to receive advice specific to you.

February 4, 2022