From Vanilla to Rocky Road – Navigating the Transformation & Risks of the S&P 500 Index

2023 has been quite an interesting year so far. Markets have been up, which is a nice change after a down year. But this has all been during the steepest rate hikes we’ve ever had in US history and we aren’t out of the “recession worry” woods quite yet. While positive performance is always welcomed, it’s important to understand where performance is coming from before we blindly trust what the market is telling us.

The S&P 500 for example has been a leading performer year-to-date, returning 16.9% in just the first 6 months. This performance however has been driven by only a select few stocks. And the index has become much more concentrated than historic norms. Given how common and relied upon this index is (as either an investment or a benchmark), it’s important that we understand the risks and significance of its performance.

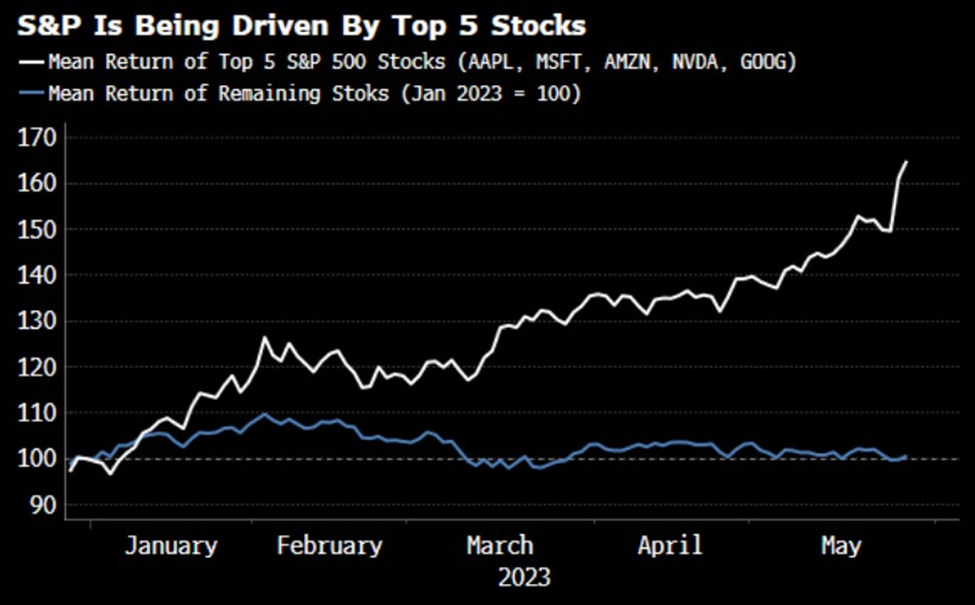

The chart below illustrates just how impactful the top 5 stocks in the S&P 500 index have been:

This is remarkable!! The index is composed of 500 stocks and yet only 5 stocks are the primary drivers of return!

As a common benchmark, this makes for a misleading indicator of the general stock market. If your US stocks are lagging the S&P, you may actually be more in line with most of the market. Of course the goal is to beat the general market, but the S&P 500 isn’t very reflective of the “general market” so far year-to-date.

While that’s helpful to know for benchmarking, anomalies of the index are also extending to increased concentration and risks for investors.

For those unfamiliar, or as a reminder, the S&P 500 index does not equally weight exposure to each company. Instead, it bases exposures off “market capitalization” or the total value of the company’s shares on the stock market (price x publicly traded shares). So, the weight or concentration of stocks in the index changes over time.

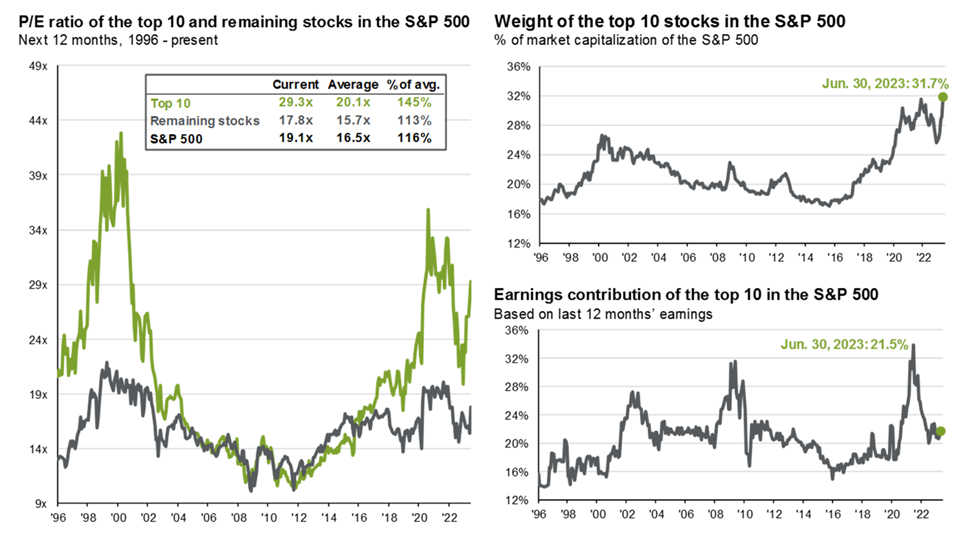

The top right chart below shows the concentration (or allocation to) the top 10 stocks in the index over time.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. The top 10 S&P 500 companies are based on the 10 largest index constituents at the beginning of each month. As of 5/31/2023, the top 10 companies in the index were AAPL (7.5%), MSFT (7.0%), AMZN (3.1%), NVDA (2.7%), GOOGL (2.1%), GOOG (1.8%), Meta (1.7%), BRK.B (1.7%), TLSA (1.6%), UNH (1.3%) and XOM (1.2%). The remaining stocks represent the rest of the 494 companies in the S&P 500. Guide to the Markets – U.S. Data are as of June 30, 2023.

As you can see, the index currently has a historically high concentration. Over 30% of the index exposure is allocated to only 10 stocks!

Or in other words, the S&P 500 has become increasingly less diversified.

Also worrisome is the bottom right chart. Typically, earnings in the top 10 stocks rise as the concentration of those top 10 stocks rise. That makes sense given how the index is composed. If companies are earning more, their prices would be expected to increase, driving up market capitalization and ultimately their exposure within the index (assuming market capitalization is increasing on a relative basis).

Currently though, earnings for these top stocks have stayed relatively flat (bottom right chart). So, investors are driving up the price on a few stocks without the justification of increased earnings. The chart to the left re-affirms all this by comparing the price/earnings ratios of the top 10 stocks in the index to the remaining.

The counter argument would be that the earnings are coming and are being priced in ahead of time. Debatable of course, but either way many investors are likely taking on more risk than they realize in the S&P. And performance baselines are skewed if using the S&P as a benchmark.

So what’s an investor to do?

Well to start, be cautious on using the S&P as a benchmark for year to date performance.

And if you have S&P 500 exposure, this is a great time to re-assess your exposure. Also keep in mind that a lot of “target date”, “growth”, “balanced” funds, etc. may have exposure to the index as well.

Regarding what to reposition into, that is a topic for further analysis and personalized recommendations.

I will however give a couple ideas to think about as it’s helpful to be aware of your options.

A couple solutions that allow for similar exposure, while mitigating some risk would be to use “equal weight index funds” or “buffered funds.”

Equal weight funds are just as they sound. The funds allocate an equal percentage (weight) to each company in the index as opposed to the “market capitalization” composition of the standard index. This reduces concentration risk and if the rest of the market “catches up” to the 5 stocks driving performance, you would benefit from this “catch up” on a relative basis.

A “buffered fund” on the other hand doesn’t change the composition of the index, but uses options to set a floor (and a ceiling) limit on performance. In other words, the fund exchanges some upside potential for downside protection. This is a great option for an investor who wants to maintain their investment exposure, while limiting downside potential in an uncertain environment.

While these are notable solutions for S&P 500 risk mitigation, there are of course more considerations to portfolio construction. These are just 2 examples of refining S&P 500 exposure. There are though countless investment solutions and ways to tailor a portfolio, depending on an investor’s goals. As always, personalized analysis is critical in determining investment solutions (flavors, tools, etc.).

.

Disclosures:

Commentary is provided only for informational purposes and should not be taken as investment advice. Commentary is general and investment advice should be unique to each individual. Please consult with a trusted advisor to receive advice specific to you.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Investment products are not FDIC Insured and may lose value.

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure.

July 19, 2023