Mortgage Strategies for Rising, Then Falling Rates

With the Federal Reserve communicating both rate hikes AND rate cuts, it’s a bit confusing on what an ideal mortgage structure would be.

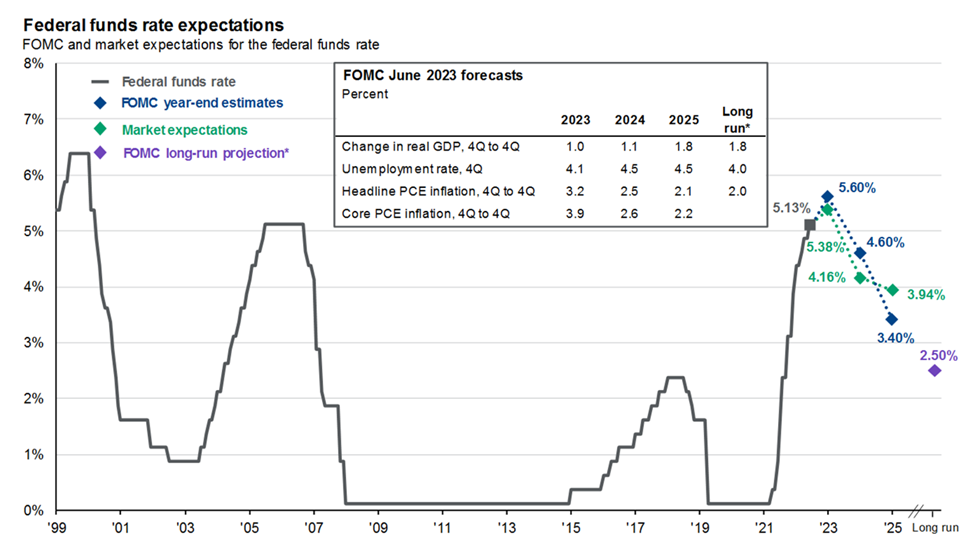

The current rate projections (below) are helpful but we should be cautious as projections can change and have been changing throughout this rate cycle.

*Source: Bloomberg, FactSet, Federal Reserve, J.P.Morgan Asset Management

Regardless of the exact peak though, our rate environment is certainly different than recent years. Given the changes, it’s important to re-visit and adjust our debt strategies accordingly. Previously, with historically low rates, a 30 year fixed mortgage was very attractive. Now however, adjustable-rate mortgages (ARMs) and “temporary buydowns” have become relatively more attractive. Also refinancing strategies are changing as our rate environment changes.

The Case for Fixed Rate

Before diving into adjustable-rate mortgages, fixed rate mortgages are still very viable and may be a fit, depending on your situation and preferences.

Of course locking in a loan at the highest, peak interest rate, isn’t ideal. But rate movements aren’t certain and a big advantage to a fixed rate mortgage is predictability. If your financial plan doesn’t have capacity to handle an increasing mortgage payment, a fixed rate mortgage will guarantee that your P&I mortgage payments stay constant.

And, if rates do substantially decrease, you can still refinance (see refinance section & ensure your mortgage doesn’t have an “early payoff penalty”).

Also, a fixed rate mortgage may be more comfortable and simpler. These can be very welcomed traits during what’s often an emotional & stressful transaction to begin with.

Adjustable-Rate Mortgages (ARMs)

For someone comfortable with some unknowns and complexity, ARMs continue to become more attractive as rates continue to rise and as long-term rates are projected to be lower.

To start, ARMs typically have lower initial interest rates than fixed mortgages. In the past, this initial attractiveness quickly faded as locking in historically low rates was hard to turn down. And long term rates were projected to increase. Now that script has flipped. Rates have increased and are projected to decrease over the next few years. This environment makes ARMs relatively more attractive, but of course there are more considerations before jumping into an ARM.

ARMs have varying structures adding complexity but also allowing for additional control. See below:

- ARMs allow for an initial interest rate lock and varying lengths for this locked term (5/1 ARM for example locks the initial rate for 5 years before adjusting).

- ARMs can have caps on how much interest rates are allowed to increase (annually, periodic and/or lifetime caps).

- Interest rates can adjust annually or every 6 months (5/1 ARM for example adjusts annually. A 5/6 ARM would adjust every 6 months – after the initial 5-year period).

- Some mortgages have an early payoff penalty. These have become less common, but you will want to make sure your loan doesn’t have this penalty to allow for re-financing flexibility.

The initial lower rate and ability to benefit from lowering rates without the need to refinance is appealing with an ARM. However, rate movements are uncertain and your initial rate lock may end up being relatively higher after future rate cuts. This is where an ARM paired with re-financing may be a great strategy. If rates decrease enough, you could then refinance and lock in the lower rate at a fixed mortgage (see refinancing section below for more details).

Temporary Buydowns

A temporary buydown mortgage has also become relatively more attractive as we are facing short-term rate hikes, but long-term rate cuts.

Temporary buydowns are also referred to as a “2 to 1 buydown” or even a “3-2-1 buydown.” These mortgage structures allow for a reduced interest rate upfront, before adjusting back to the standard/current market rate. These mortgages can also be set to be fixed or adjustable after the initial buydown period.

To be clear though, the initial reduction and subsequent step ups in rate are not adjustable with market rates. With a buydown, there are pre-determined rate discounts, independent from market rate movements.

In a 2 to 1 buydown for example, the borrower would receive a 2% interest rate reduction during the first year and a 1% rate reduction during the second year. Then payments would resume at the market rate in the 3rd year. This market rate is set at the time of loan origination.

These initial lower rates are of course the appeal, but they do come at a cost. Buydown mortgages have higher up-front costs and require points to be paid (or upfront interest). Depending on what the mortgage terms are though, you may still find this structure beneficial.

And beyond the lower initial rate, borrowers can often qualify for a larger mortgage since their initial payments will be lower. Just be cuatious that you don’t take on a mortgage that you can’t afford, especially as your rate and payments step up.

Also, buyers and/or sellers can both pay the upfront costs of the buydown. A seller may pay these costs to entice buyers, or to negotiate a higher sales price.

And finally, just as with the ARM, if rates do decrease, a refinance may pair well with a temporary buydown mortgage (see refinancing section below).

No matter the mortgage structure though, it’s important to work with your mortgage team to help you with your options. These are a few structures that are good to be aware of, that you can mention to your mortgage team for a new mortgage, or…for a refinance.

Refinancing Considerations

As mentioned above, refinancing becomes much more appealing with rates dropping. As a pre-emptive word of caution though, it’s important to weigh the costs (loan closing costs, any early payoff penalty) of refinancing against the benefits. And if rates continue to move down, will you continue to be enticed to refinance, driving up your refinancing costs even more?

We will help clients assess these costs/benefits when the time comes, but it’s worth a pre-emptive word of caution before a rate decrease tempts you into a quick refinance.

And while there is the more obvious case for a refinance once rates drop, there are cases for restructuring your debt now, even with rates near their projected peak.

This may seem counter intuitive, but see the considerations below:

- New debts incurred, especially unsecured debts, may be at relatively high rates.

- Home loans often offer lower rates than unsecured debt (credit cards, student loans, personal loans).

- You can take a second loan and don’t have to scrap your current mortgage, if you do have a locked in low rate. Also, you can use any of the mortgage options above as a home equity loan or as a re-finance.

- Home values have recently appreciated – If your home appreciated, you have more equity in your home and greater access to loan potential.

- Interest on home loans have the potential for a tax deduction.

These are interesting considerations but of course more analysis is needed. And I’ll stress that I am not necessarily recommending someone refinance out of their very attractive, low, fixed rate mortgage.

Taking on more debt is a risk, so caution should be used with any of these strategies.

That said, accessing equity in a home isn’t often the first thought someone has when they need excess funds. If someone thought to open a credit card or finds that their student loan payments (shortly resuming) have a higher rate than they expected, tapping into their home equity may be a great strategy to consolidate debt and reduce their overall interest payments.

Disclosures:

Commentary is provided only for informational purposes and should not be taken as advice. Commentary is general and advice should be unique to each individual. Please consult with a trusted advisor to receive advice specific to you.

Impact Financial, LLC (“Impact Financial”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Impact Financial and its representatives are properly licensed or exempt from licensure.

July 13, 2023